Report on the audit of the financial statements

Opinion on the financial statements of Irish Continental Group plc (the “Company”)

In our opinion, the Group and parent Company financial statements:

- give a true and fair view of the assets, liabilities and financial position of the Group and parent Company as at 31 December 2019 and of the profit of the Group for the financial year then ended; and

- have been properly prepared in accordance with the relevant financial reporting framework and in particular, with the requirements of the Companies Act 2014 and, as regards the Group financial statements, Article 4 of the IAS Regulation.

The financial statements we have audited comprise the:

the Group financial statements:

- the Consolidated Income Statement;

- the Consolidated Statement of Comprehensive Income;

- the Consolidated Statement of Financial Position;

- the Consolidated Statement of Changes in Equity;

- the Consolidated Cash Flow Statement;

- the related notes 1 to 37, including a summary of significant accounting policies as set out in note 2 to the financial statements.

the parent Company financial statements:

- the Company Statement of Financial Position;

- the Company Statement of Changes in Equity;

- the Company Cash Flow Statement;

- the related notes 38 to 56, including a summary of significant accounting policies as set out in note 38 to the financial statements.

The relevant financial reporting framework that has been applied in the preparation of the Group financial statements is the Companies Act 2014 and International Financial Reporting Standards (IFRS) as adopted by the European Union (“the relevant financial reporting framework”). The relevant financial reporting framework that has been applied in the preparation of the parent Company financial statements is the Companies Act 2014 and FRS 101 “Reduced Disclosure Framework” issued by the Financial Reporting Council.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (Ireland) (ISAs (Ireland)) and applicable law. Our responsibilities under those standards are described below in the “Auditor’s responsibilities for the audit of the financial statements” section of our report.

We are independent of the Group and parent Company in accordance with the ethical requirements that are relevant to our audit of the financial statements in Ireland, including the Ethical Standard issued by the Irish Auditing and Accounting Supervisory Authority (IAASA), as applied to public interest entities, and we have fulfilled our other ethical responsibilities in accordance with these requirements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Summary of our audit approach

| Key audit matters |

The key audit matters that we identified in the current year are as follows:

There have been no significant changes to the key audit matters since the prior financial year report. |

| Materiality |

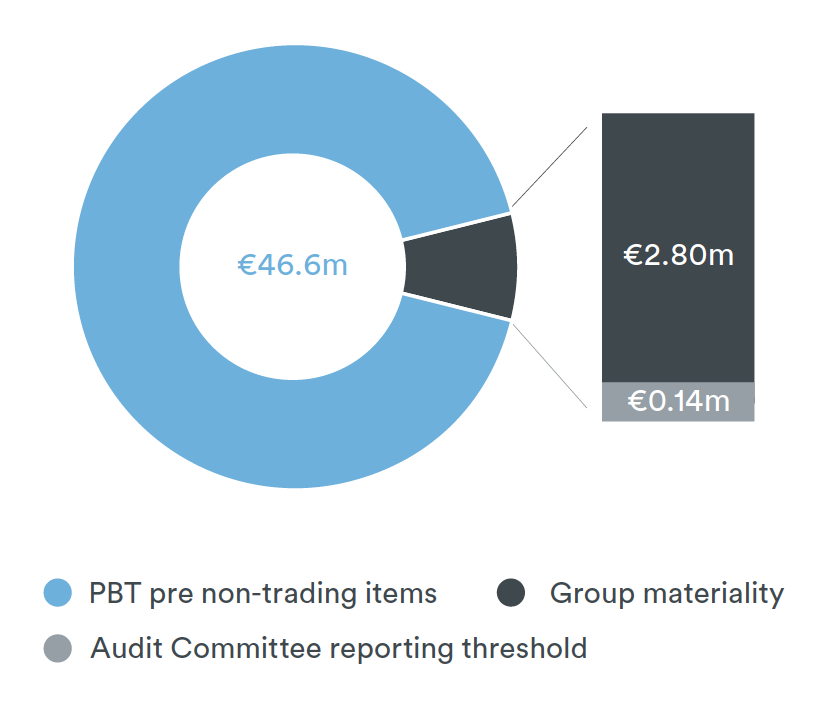

The materiality that we used in the current year for the Group was €2.8m which was determined on the basis of profit before tax and non-trading items. The materiality that we used in the current year for the parent Company was €1.96m which was determined on the basis of net assets. |

| Scoping |

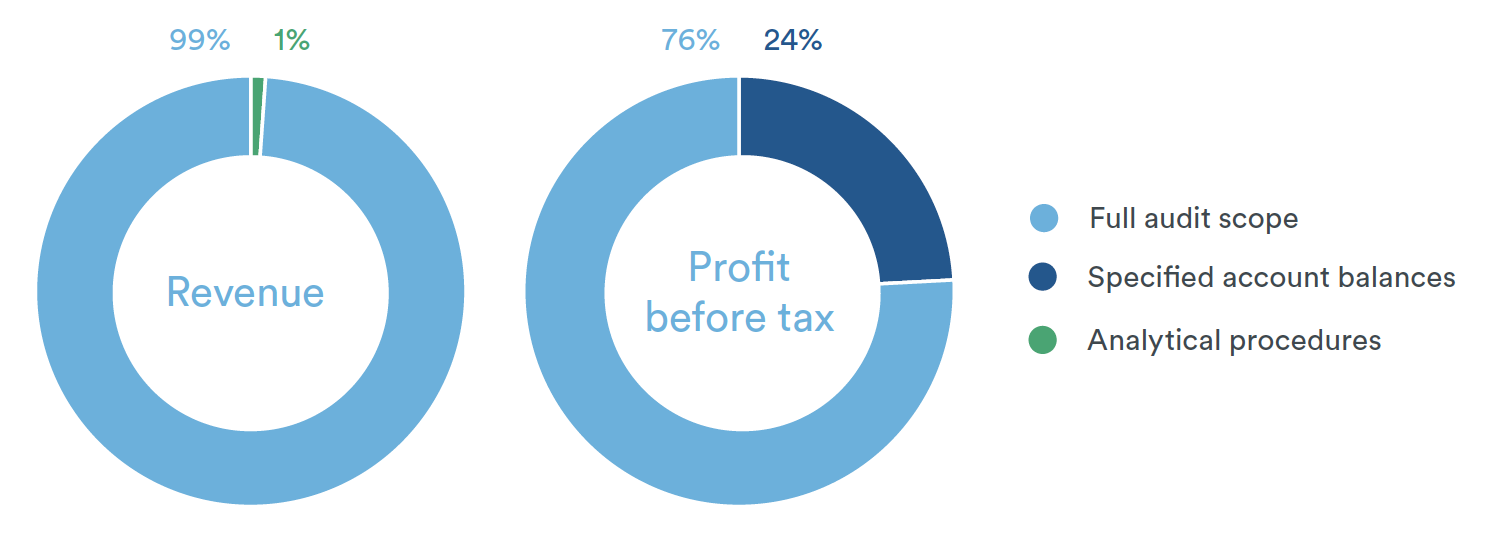

We determined the scope of our Group audit by obtaining an understanding of the Group and its environment, including Group-wide controls, and assessing the risks of material misstatement at the Group level. Based on that assessment, we focused our Group audit scope primarily on the audit work in fifteen components. Five of these were subject to a full scope audit, a further five components were subject to audits of specified account balances and the remaining five entities were subject to analytical procedures. |

| Significant changes in our approach |

There were no significant changes in our audit approach in the current year, the activities of the Group remained consistent year on year. |

Conclusions relating to principle risks, going concern and viability statement

We have nothing to report in respect of the following information in the annual report, in relation to which ISA (Ireland) or the Listing Rules require us to report to you whether we have anything material to report, add or draw attention to:

- the directors’ confirmation in the annual report on page 67 that they have carried out a robust assessment of the principal and emerging risks facing the Group and the parent Company, including those that would threaten its business model, future performance, solvency or liquidity;

- the disclosures on pages 52 to 57 to the annual report that describe the principal risks, procedures to identify emerging risks, and an explanation of how these are being managed or mitigated;

- the directors’ statement on page 66 in the financial statements about whether the directors consider it appropriate to adopt the going concern basis of accounting in preparing the financial statements and the directors’ identification of any material uncertainties to the Group’s and the parent Company’s ability to continue to do so over a period of at least twelve months from the date of approval of the financial statements;

- whether the directors’ statement relating to going concern required under the Listing Rules in accordance with Listing Rule 6.1.82(3) is materially inconsistent with our knowledge obtained in the audit; or

- the directors’ explanation on page 67 in the annual report as to how they have assessed the prospects of the Group and parent Company, over what period they have done so and why they consider that period to be appropriate, and their statement as to whether they have a reasonable expectation that the Group and parent Company will be able to continue in operation and meet its liabilities as they fall due over the period of their assessment, including any related disclosures drawing attention to any necessary qualifications or assumptions.

Key Audit Matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current financial year and include the most significant assessed risks of material misstatement (whether or not due to fraud) we identified, including those which had the greatest effect on: the overall audit strategy, the allocation of resources in the audit, and directing the efforts of the engagement team. These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

Appropriateness of the useful lives and residual values of vessels used in the determination of the depreciation charge.

| Key audit matter description |

There is a risk that management’s estimate of useful lives and residual values of vessels is inaccurate leading to an impact on the depreciation charge. The Group holds €429.10m of vessels, as at 31 December 2019. The annual depreciation charge depends primarily on the estimated lives of each type of vessel and the estimated residual value, as determined by management. The determination of appropriate estimates requires significant judgement by management and relies on inputs that are variable such as the value of scrap metal and the estimated residual value of vessels. A change in the estimate of useful lives or residual value of vessels can have a significant impact on the amount of depreciation charged to the Income Statement. Please also refer to page 83 (Audit Committee Report), page 133 (Accounting Policy – Property, Plant & Equipment), and note 3 – Critical accounting judgements and key sources of estimation uncertainty and note 13 Property, Plant & Equipment. |

| How the scope of our audit responded to the key audit matter |

We examined management’s assessment of useful lives and estimated residual values of these vessels. We obtained an understanding of management’s processes and performed testing of relevant controls, which included reviews by senior members of management and the Board to ensure the current assumptions used are appropriate. We challenged and evaluated management’s key assumptions including their assessment of useful lives and their estimates of residual values. As part of this, we performed sensitivity analysis on the key assumptions to assess the impact of various changes on the annual depreciation charge for the year. We benchmarked management’s assumptions against information available from external independent market sources, such as:

We evaluated and assessed the adequacy of the disclosures made in the financial statements, including the disclosure of the key assumptions and the sensitivity of the depreciation charge to changes in the underlying assumptions. We determined that management’s assessment of the useful lives of the vessels and residual values to be reasonable based on the work that we undertook. |

Appropriateness of key assumptions used to determine retirement benefit liabilities

| Key audit matter description |

There is a risk that the liabilities of pension schemes are determined using inappropriate actuarial assumptions, leading to potential misstatement of the net pension asset/deficit. The Group operates a number of defined benefit schemes. The net pension asset at the year end amount to €8.8m consisting of pensions assets of €12.5m and deficits of €3.7m. There is a high degree of estimation and judgement in the calculation of the pension liabilities, particularly in the determination of appropriate actuarial assumptions in respect of the discount, mortality and inflation rates. We identified the discount rate as the being most volatile key assumption where a small movement can have a significant impact on the calculation of the pension liabilities. Please also refer to page 83 (Audit Committee Report), page 132 (Accounting Policy – Retirement Benefit Schemes), and note 3 – Critical accounting judgements and estimates |

| How the scope of our audit responded to the key audit matter |

The following audit procedures were performed in order to assess the Group’s valuation of its retirement benefit liabilities, we;

Based on the evidence obtained, we found that the discount rate and other assumptions used by management in the actuarial valuations for pension liabilities are within a range we consider reasonable. |

Cut-off of revenue recognized in the current year

| Key audit matter description |

There is a risk that revenues are manipulated through recording of future revenues prematurely to achieve performance targets. When making our assessment of the potential risk of fraud in relation to revenue recognition, we considered the nature of the transactions across the Group. The Group recognises revenue in respect of its various streams over the performance period of the underlying contract obligations. We have therefore pinpointed the significant risk across the Group to the proper cutoff of revenue recorded at year end. Please also refer to page 128 (Accounting Policy – Revenue Recognition), note 4 segmental information. |

| How the scope of our audit responded to the key audit matter |

We obtained an understanding of the significant revenue arrangements in place across the Group, and of the internal controls and IT systems in place over those revenue streams. We performed testing of relevant internal controls over the Group’s significant revenue processes including operational controls in place around passenger numbers and freight volumes to ensure that revenue was recognised where the date of travel or transportation had occurred. We tested on a sample basis, revenue recognised around year end for the various revenue streams across the Group to assess if the performance obligations were met in line with the underlying contractual arrangements with customers for the associated revenue recognised to ensure that it was recognised appropriately. No significant matters arose from our work. |

Our audit procedures relating to these matters were designed in the context of our audit of the financial statements as a whole, and not to express an opinion on individual accounts or disclosures. Our opinion on the financial statements is not modified with respect to any of the risks described above, and we do not express an opinion on these individual matters.

Our application of materiality

We define materiality as the magnitude of misstatement that makes it probable that the economic decisions of a reasonably knowledgeable person, relying on the financial statements, would be changed or influenced. We use materiality both in planning the scope of our audit work and in evaluating the results of our work.

We determined materiality for the Group to be €2.8m, which is approximately 6% of profit before tax and nontrading items. We have considered the profit before tax and non trading items to be the appropriate benchmark for determining materiality because it is the most important measure for users of the Group’s financial statements and it excludes the effect of volatility (for example, separately disclosed non-trading items) from our determination. We determined materiality for the parent Company to be €1.96m which is approximately 1.1% of net assets, as the most significant driver of the parent Company financial statements is the capital and reserves balance.

We have considered quantitative and qualitative factors, such as understanding the entity and its environment, history of misstatements, complexity of the Group and reliability of the control environment.

We agreed with the Audit Committee that we would report to them all audit differences in excess of €140,000 as well as differences below this threshold that, in our view, warranted reporting on qualitative grounds. We also report to the Audit Committee on disclosure matters that we identified when assessing the overall presentation of the financial statements.

An overview of the scope of our audit

We determined the scope of our Group audit by obtaining an understanding of the Group and its environment, including Group-wide controls, and assessing the risks of material misstatement at the Group level. Based on that assessment, we focused our Group audit scope primarily on the audit work in fifteen components. Five of these were subject to a full scope audit and five components were subject to audits of specified account balances, where the extent of our testing was based on our assessment of the risks of material misstatement and of the materiality of the Group’s operations in those components. The remaining five entities were subject to analytical procedures at the Group level.

These components were selected based on coverage achieved and to provide an appropriate basis for undertaking audit work to address the risks of material misstatement identified above. Our audit work at the fifteen components was executed at levels of materiality applicable to each individual unit which were lower than Group materiality and ranged from €1.40m to €2.52m.

At the Group level, we also tested the consolidation process and carried out analytical procedures to confirm our conclusion that there were no significant risks of material misstatement of the aggregated financial information of the remaining components not subject to audit or audit of specified account balances.

The Group audit team attended planning meetings for all components. In addition to our planning meetings, we sent detailed instructions to our component audit teams, included them in our team briefings, discussed their risk assessment, attended client planning and closing meetings, and reviewed their audit working papers.

The levels of coverage of key financial aspects of the Group by type of audit procedures are as set out below:

Other information

The directors are responsible for the other information. The other information comprises the information included in the annual report, other than the financial statements and our auditor’s report thereon. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in this regard.

In this context, we also have nothing to report with regard to our responsibility to specifically address the following items in the other information and to report as uncorrected material misstatements of the other information where we conclude that those items meet the following conditions:

- Fair, balanced and understandable – the statement given by the directors that they consider the annual report and financial statements taken as a whole is fair, balanced and understandable and provides the information necessary for shareholders to assess the Group’s and the parent Company’s position and performance, business model and strategy, is materially inconsistent with our knowledge obtained in the audit; or

- Audit committee reporting – the section describing the work of the audit committee does not appropriately address matters communicated by us to the audit committee; or

- Directors’ statement of compliance with the UK Corporate Governance Code and the Irish Corporate Governance Annex - the parts of the directors’ statement required under the Listing Rules relating to the Company’s compliance with the UK Corporate Governance Code and the Irish Corporate Governance Annex containing provisions specified for review by the auditor in accordance with Listing Rule 6.1.85 and Listing Rule 6.1.86 do not properly disclose a departure from a relevant provision of the UK Corporate Governance Code or the Irish Corporate Governance Annex.

Responsibilities of directors

As explained more fully in the Directors’ Responsibilities Statement, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view and otherwise comply with the Companies Act 2014, and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the Group and parent Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the Group and parent Company or to cease operations, or have no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (Ireland) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with ISAs (Ireland), we exercise professional judgment and maintain professional scepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control;

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group and parent Company’s internal control;

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the directors;

- Conclude on the appropriateness of the directors’ use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group and parent Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of the auditor’s report. However, future events or conditions may cause the entity (or where relevant, the Group) to cease to continue as a going concern;

- Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation;

- Obtain sufficient appropriate audit evidence regarding the financial information of the business activities within the Group to express an opinion on the (consolidated) financial statements. The Group auditor is responsible for the direction, supervision and performance of the Group audit. The Group auditor remains solely responsible for the audit opinion.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that the auditor identifies during the audit.

For listed entities and public interest entities, the auditor also provides those charged with governance with a statement that the auditor has complied with relevant ethical requirements regarding independence, including the Ethical Standard for Auditors (Ireland) 2016, and communicates with them all relationships and other matters that may be reasonably be thought to bear on the auditor’s independence, and where applicable, related safeguards.

Where the auditor is required to report on key audit matters, from the matters communicated with those charged with governance, the auditor determines those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. The auditor describes these matters in the auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, the auditor determines that a matter should not be communicated in the auditor’s report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

This report is made solely to the Company’s members, as a body, in accordance with Section 391 of the Companies Act 2014. Our audit work has been undertaken so that we might state to the Company’s members those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company’s members as a body, for our audit work, for this report, or for the opinions we have formed.

Report on other legal and regulatory requirements

Opinion on other matters prescribed by the Companies Act 2014

Based solely on the work undertaken in the course of the audit, we report that:

- We have obtained all the information and explanations which we consider necessary for the purposes of our audit;

- In our opinion the accounting records of the parent Company were sufficient to permit the financial statements to be readily and properly audited;

- The parent Company statement of financial position is in agreement with the accounting records;

- In our opinion the information given in the directors’ report is consistent with the financial statements and the directors’ report has been prepared in accordance with the Companies Act 2014.

Corporate Governance Statement

We report, in relation to information given in the Corporate Governance Report on pages 70 to 82 that:

- In our opinion, based on the work undertaken during the course of the audit, the information given in the Corporate Governance Statement pursuant to subsections 2(c) and (d) of section 1373 of the Companies Act 2014 is consistent with the Company’s statutory financial statements in respect of the financial year concerned and such information has been prepared in accordance with the Companies Act 2014.

Based on our knowledge and understanding of the Company and its environment obtained in the course of the audit, we have not identified any material misstatements in this information.

- In our opinion, based on the work undertaken during the course of the audit, the Corporate Governance Statement contains the information required by Regulation 6(2) of the European Union (Disclosure of Non-Financial and Diversity Information by certain large undertakings and Groups) Regulations 2017 (as amended); and

- In our opinion, based on the work undertaken during the course of the audit, the information required pursuant to section 1373(2)(a),(b),(e) and (f) of the Companies Act 2014 is contained in the Corporate Governance Statement.

Matters on which we are required to report by exception

Based on the knowledge and understanding of the Group and parent Company and its environment obtained in the course of the audit, we have not identified material misstatements in the directors’ report.

We have nothing to report in respect of the provisions in the Companies Act 2014 which require us to report to you if, in our opinion, the disclosures of directors’ remuneration and transactions specified by law are not made.

The Listing Rules of the Euronext Dublin require us to review six specified elements of disclosures in the report to shareholders by the Board of Directors’ remuneration committee. We have nothing to report in this regard.

Other matters which we are required to address

We were first appointed by Irish Continental Group plc to audit the financial statements for the financial year ended 31 October 1988 and subsequent financial periods. The period of total uninterrupted engagement including previous renewals and reappointments of the firm is 31 years, covering the years ending 31 October 1988 and 31 December 2019.

The non-audit services prohibited by IAASA’s Ethical Standard were not provided and we remained independent of the Company in conducting the audit.

Our audit opinion is consistent with the additional report to the audit committee we are required to provide in accordance with ISA (Ireland) 260.

Ciarán O’Brien

For and on behalf of Deloitte Ireland LLP

Chartered Accountants and Statutory Audit Firm

Deloitte & Touche House, Earlsfort Terrace, Dublin 2

6 March 2020