The Committee ensures that the remuneration structures and levels are set to attract and retain high calibre individuals necessary at executive director and senior manager level and to motivate their performance in the best interests of shareholders. This report sets out how the Committee fulfilled its responsibilities under its Terms of Reference and details the remuneration outcomes for the executive Directors.

The current remuneration framework was adopted during 2017 following the approval by shareholders at the 2017 AGM of the Performance Share Plan. The Committee reviewed the framework during the year taking into account feedback from shareholders following engagement and remain satisfied that it continues to be appropriate for the Group’s business needs and strategy.

As the Company is subject to Company Law as enacted in Ireland, the Company is not required to seek shareholder approval for its Remuneration Policy or this Report. However, the company will be submitting this report to shareholders as an advisory resolution at the 2020 AGM.

Composition

The Committee membership is set out in the table below which also details attendance and tenure. All Directors bring significant professional expertise to their roles on this Committee as set out in their professional biographies on page 64.

| Member | A | B | Tenure |

|---|---|---|---|

| B. O’ Kelly (Chair) | 2 | 2 | 7 years |

| J. Sheehan | 2 | 2 | 6 years |

| C. Duffy | 2 | 2 | 3 years |

Column A: the number of scheduled meetings held during the year where the Director was a member of the Committee.

Column B: the number of scheduled meetings attended during the year where the Director was a member of the Committee.

Role and Responsibilities

The role, responsibilities and duties of the Committee are set out in written terms of reference which are reviewed annually. The terms of reference are available on the Group’s website www.icg.ie.

The Committee’s duties are to establish a remuneration framework that;

- Will attract, motivate and retain high calibre individuals;

- Will reward individuals appropriately according to their level of responsibility and performance;

- Motivate individuals to perform in the best interest of the shareholders; and

- Will not encourage individuals to take risks in excess of the Company’s risk appetite.

Against this framework the Committee approves remuneration levels and awards based on an individual’s contribution to the Company against the background of underlying Company financial performance having regard to comparable companies in both size and complexity.

Meetings

The Committee met twice during the period. The Chairman provided an update to the Board on key matters discussed.

The work performed included consideration of levels of executive Director and senior management remuneration. The level of basic salaries were reviewed by the Committee having regard to job specification, level of responsibility, individual performance and market practice. The Committee approved performance awards, to certain employees, based on Group, business unit and individual performance. The Committee determined the vesting of second tier options under the 2009 Share Option Plan previously granted during 2014. The Committee also undertook a review of the existing remuneration framework adopted during 2017.

Remuneration framework

We are of the view that any remuneration framework should seek to create strong linkages to longer-term Company performance and alignment with shareholder interests through growth in equity value. To achieve this the Committee seeks to set base salaries at median market levels and structure performance awards in a manner that encourages individuals to acquire and retain significant long-term shareholdings relative to base salary that are above market norms.

The Committee during the year reviewed the remuneration framework first adopted during 2017. The Committee acknowledges that full implementation may in certain instances be constrained by pre-existing contractual arrangements. Notwithstanding the Committee remained satisfied that it continues to be appropriate to the business needs and strategy of the Group. In particular the Committee notes the promotion of strong alignment with shareholders through requirements of minimum shareholdings, remuneration of 50% of annual performance awards with shares with a five year holding requirement and the overall eight year alignment period for any awards granted under the longer-term Performance Share Plan. These elements are further supported by clawback provisions. This is consistent with the Group’s ongoing investment in long life assets. The Committee also reviewed the movements in remuneration levels against longer-term performance and total remuneration amounts against market levels generally.

Corporate Governance Code

The Corporate Governance Code 2018 (the Code) introduced a number of changes over the previous version of the Code in the area of remuneration including requirements for;

- Remuneration schemes to promote long-term shareholdings by executive directors;

- Post-employment shareholding requirements;

- Ability to override formulaic outcomes; and

- Alignment of executive Director pension contributions with those available to the workforce.

The Committee determined that the existing framework has already addressed these matters as discussed later in this report. However, it is noted that the Remuneration Framework was silent in relation to alignment of executive Director pension contributions with those available to the workforce. The Committee confirms that executive Director pension participation is substantially on the same terms as those generally available to the workforce. The Remuneration Framework has been updated to include existing practice. The Committee is also satisfied that the Remuneration Framework is transparent, avoids complexity, encourages acceptable risk taking and is aligned to long-term Company performance and culture.

Remuneration Framework (adopted with effect from 1 January 2017)

| Element | Operation | Maximum Opportunity | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Base Salary To attract and retain high calibre individuals. |

Base salaries are reviewed by the Committee annually in the last quarter of the year with any adjustments to take effect from 1 January of the following year. Factors taken into account in the review include the individual’s role and level of responsibility, personal performance and general developments in pay in the market generally and across the Group. |

There is no prescribed maximum salaries or maximum increases. Increases will broadly reflect increases across the Group and in the market generally. Increases may be higher to reflect changes in responsibility or market changes and in the case of newly appointed individuals to progressively align salary with market norms. |

||||||||||||||||||

| Retirement Benefits To attract and retain high calibre individuals. |

Certain individuals are members of a defined benefit pension scheme where contributions are determined by the scheme actuary pursuant to the benefits offered under the scheme rules. Other individuals are members of a defined contribution pension scheme where the Company has discretion to pay appropriate contributions as a percentage of base salary as agreed by the Company and individual under their contract of employment. In certain circumstances the Company may provide an equivalent cash payment in lieu of pension contributions. |

There are no prescribed maximum levels of pension contribution though Executive Director participation is substantially on the same terms as for the workforce generally. No element of remuneration other than base salary is pensionable. |

||||||||||||||||||

| Other Benefits To be competitive with the market. |

Benefits may include the use of a company car or an equivalent cash amount, club subscriptions, life and health insurance. | No maximum levels are prescribed as benefits will be related to each individual circumstance. | ||||||||||||||||||

| Annual Bonus To reward achievement of annual performance targets. |

Individuals will receive annual bonus awards based on the achievement of financial targets and personal objectives agreed prior to the start of each financial year. Threshold levels will be set for minimum and maximum awards with pro-rata payments between the two points. Due to commercial sensitivity the targets will not be disclosed in advance but may be disclosed retrospectively. For executive Directors and members of the executive committee a minimum of 50% of any bonus earned, after allowing for payroll taxes, will be invested in ICG equity which must be held for a period of 5 years. A formal clawback policy whereby all or a portion of the share award is subject to clawback for a period of two years in certain circumstances. Further details of the clawback policy are on page 101. The Committee retains discretion to adjust any award to reflect the underlying financial position of the Company and to agree awards outside of the above framework in respect of recent joiners and leavers. |

The maximum award in any period of 12 months may not exceed 200% of base salary in the case of the CEO and 150% of base salary in the case of any other individual. An existing contractual annual bonus arrangement will continue to apply to the existing CEO Mr. Eamonn Rothwell in lieu of the arrangements described here and is explained in further detail under the report on 2019 executive Director remuneration outcomes. |

||||||||||||||||||

| Performance Share Plan (PSP) To align the interests of individuals with the long-term interests of the Company’s shareholders. |

The Committee will grant nominal cost options to individuals to acquire equity in the Company. The vesting period is normally 3 years with the extent of vesting based on the performance conditions set out below. Any vesting of awards is subject to the Committee discretion that it is satisfied that the Company’s underlying performance has shown a sustained improvement in the period since the date of grant. No re-testing of the vesting performance conditions is permitted. Options will normally be exercised upon vesting and any ICG equity delivered to an individual will be held for a period of 5 years, except to the extent that the Committee allow such number of the shares delivered to be sold to facilitate the discharge of any tax liabilities. The plan incorporates market standard good leaver / bad leaver provisions. Options may vest early in the event of a takeover, merger, scheme of arrangement or other similar event involving a change of control of the Company, subject to the pro-rating of the share awards, to reflect the shortened performance period since the date of grant, though the Committee can exercise its discretion not to apply pro-rating if it considers it to be inappropriate given any particular circumstances. The Committee in exercising its discretion under the rules of the PSP may (i) re-calibrate the performance conditions and change their relative weightings (ii) introduce new and retire old performance measures; provided that any changes are no less challenging, are aligned with the interests of the Company’s shareholders and are disclosed in the Committee’s report to shareholders. A formal clawback policy whereby all or a portion of the share award is subject to clawback for a period of two years post vesting in certain circumstances. Further details of the clawback policy are on page 101. The performance conditions, which are measured over a three year vesting period are currently based on;

Each condition is equally weighted and in all cases 30% vests at threshold performance and 100% vests at maximum with pro-rata vesting between these two levels. The performance levels are currently calibrated as follows;

|

The market value of any PSP awards in any period of 12 months may not exceed 200% of base salary in the case of the CEO and 150% of base salary in the case of any other individual. In exceptional situations, including recruitment, higher awards may be granted but not exceeding 300% of base salary. |

||||||||||||||||||

| Shareholding Requirement To align the interests of individuals with the long-term interests of the Company’s shareholders. |

All executive Directors and members of the Executive Committee are expected to maintain a minimum shareholding of 300% of base salary. Individuals are allowed a five year period from date of first appointment to achieve the required holding. The market value of vested options and any shares held under the Company’s restricted share arrangements will count towards determining an individual’s holdings. |

Not applicable. |

||||||||||||||||||

Remuneration Outcomes for Executive Directors in 2019

Total Directors’ single figure for Director’s remuneration for the year was €4,075,000 compared with €2,880,000 in 2018 and details are set in the table below:

| Performance pay | ||||||||

|---|---|---|---|---|---|---|---|---|

| Base salary | Restricted shares | Cash | Benefits | Pension | Options / PSP1/2 | Fees | Total 2019 | |

| €'000 | €'000 | €'000 | €'000 | €’000 | €’000 | €’000 | €'000 | |

| Executive Directors | ||||||||

| E. Rothwell | 566 | 1,558 | - | 35 | - | 898 | 3,057 | |

| D. Ledwidge | 254 | 76 | 90 | 22 | 36 | 265 | 743 | |

| Total for executives | 820 | 1,634 | 90 | 57 | 36 | 1,163 | 3,800 | |

| Non-executive Directors | ||||||||

| J. B. McGuckian | - | - | - | - | - | - | 125 | 125 |

| C. Duffy | - | - | - | - | - | - | 50 | 50 |

| B. O’Kelly | - | - | - | - | - | - | 50 | 50 |

| J. Sheehan | - | - | - | - | - | - | 50 | 50 |

| Total for non-executives | - | - | - | - | - | - | 275 | 275 |

| Total | 820 | 1,634 | 90 | 57 | 36 | 1,163 | 275 | 4,075 |

1. 100% of the second tier options granted on 4 March 2015 under the 2009 Share Option Plan and 44% of the options granted on 23 May 2017 under the PSP will vest during 2020 based on performance to 31 December 2019, subject to continued employment up to the vesting date.

2. The value of any options vesting will be based on the actual share price at date of vesting. For the purposes of the above disclosure the value of an option has been based on the difference between the option subscription price and the average closing price of an ICG unit between 1 October and 31 December 2019.

Details of Directors’ remuneration for the year ended 31 December 2018 are set out below:

| Performance pay | ||||||||

|---|---|---|---|---|---|---|---|---|

| Base salary | Restricted shares | Cash | Benefits | Pension | Options / PSP1 | Fees | Total 2018 | |

| €'000 | €'000 | €'000 | €'000 | €’000 | €’000 | €’000 | €'000 | |

| Executive Directors | ||||||||

| E. Rothwell | 552 | 1,572 | - | 35 | - | - | - | 2,159 |

| D. Ledwidge | 221 | 108 | 62 | 22 | 33 | - | - | 446 |

| Total for executives | 773 | 1,680 | 62 | 57 | 33 | - | - | 2,605 |

| Non-executive Directors | ||||||||

| J. B. McGuckian | - | - | - | - | - | - | 125 | 125 |

| C. Duffy | - | - | - | - | - | - | 50 | 50 |

| B. O’Kelly | - | - | - | - | - | - | 50 | 50 |

| J. Sheehan | - | - | - | - | - | - | 50 | 50 |

| Total for non-executives | - | - | - | - | - | - | 275 | 275 |

| Total | 773 | 1,680 | 62 | 57 | 33 | - | 275 | 2,880 |

1. None of the executive Directors held options which vested during 2019 based on performance to 31 December 2018.

In relation to Mr. Eamonn Rothwell €0.3 million (2018: €0.2 million) of performance pay has been included as a non-trading item (note 10) in relation to the disposal of the Oscar Wilde (2018: in relation to the disposal of the Jonathan Swift).

The information above forms an integral part of the audited Consolidated Financial Statements as described in the Basis of Preparation on page 124.

Base Salary

Eamonn Rothwell, CEO, was awarded an increase in base salary of 2.5% in 2019 over his 2018 base salary. This was in line with the base salary increase awarded to all employees who are not accruing benefits under any of the Group’s defined benefit pension schemes. In terms of a wider comparator Group the Committee noted that the CEO pay level was below median base salaries of FTSE 250 constituent companies.

Mr. David Ledwidge, CFO, was appointed to the Board on 3 March 2016. His salary at that date was set at a level commensurate with his experience with the Group with the expectation that subject to individual and Group performance that this level of salary will rise progressively over a number of years to comparable levels in the market for similar roles. Against these considerations, in 2019, the Committee awarded Mr. David Ledwidge a 15% increase in annualised base salary.

Director’s Pension benefits

The aggregate pension benefits attributable to the executive Directors at 31 December 2019 are set out below:

| E. Rothwell €'000 |

D. Ledwidge €'000 |

Total 2019 €'000 |

Total 2018 €'000 |

|

|---|---|---|---|---|

| Increase in accumulated accrued annual benefits (excluding inflation) in the period | - | 1 | 1 | 1 |

| Transfer value of the increase in accumulated accrued benefits (excluding inflation) at year end* | - | 4 | 4 | 3 |

| Accumulated accrued annual benefits on leaving service at year end | - | 16 | 16 | 15 |

* Note: Calculated in accordance with actuarial Guidance note GNII.

There were no pension benefits attributable to Mr. Eamonn Rothwell as he has reached normal retirement age and pension benefits have vested.

In relation to Mr. David Ledwidge costs in relation to defined benefit pension arrangements was €20,000 (2018: €20,000) with a further €16,000 (2018: €13,000) related to the defined contribution pension arrangements.

The Company also provides lump sum death in service benefits and the premiums paid during the year amounted to €6,000 and €1,000 in relation to Eamonn Rothwell and David Ledwidge respectively.

Performance Related Pay

Eamonn Rothwell

Eamonn Rothwell has been associated with ICG since its inception as a public company and floatation in 1988. A legacy contractual arrangement governs Mr. Rothwell’s performance related pay.

The CEO annual bonus performance award is predominantly driven by a formula based on basic EPS growth which incorporates an adjustment for share buybacks. The Committee also retain discretion to make adjustments for any non-cash non-trading items. The Company believes that EPS is consistent and transparent and EPS growth drives long-term value creation in the business, reflected in share price appreciation. EPS is the key performance indicator by which the Board assesses the overall performance of the Company.

As part of the remuneration framework review the Committee reassessed the CEO performance arrangements and in its view the arrangements remain appropriate. In carrying out this assessment the Committee has considered the arrangements over the longer-term performance of the Company rather than on a single year basis and noted that 100% of the annual performance award was remunerated through the allocation of ICG shares with a five year holding period.

David Ledwidge

David Ledwidge was appointed Executive Director on 6 March 2016. The Committee assessed Mr. Ledwidge’s performance in his role over the period and in particular his development within the sphere of his greater responsibility. The assessment concluded that Mr. Ledwidge was performing in line with expectations which included his contribution to investment appraisal, capital management, investor relations and systems development all supporting the longer-term development of the Group. On this basis, taking account of market norms and the expectation that, subject to performance at an individual and Company level, his remuneration would rise progressively over a number of years to comparable levels in the market for similar roles the Committee concluded that an annual performance award of €166,000, being 65% of annualised base salary was appropriate. Of this annual performance award, 46% was allocated towards the acquisition of restricted shares (before tax liabilities) with the balance received in cash.

Restricted Shares

In relation to any element of the annual performance award remunerated through the restricted share plan, shares are held in trust for the beneficiaries and may not be sold for a period of 5 years and one month from the date of grant, aligning the value of the award with Group performance over the restricted period.

Long-Term Incentive

Grants during 2019

The long-term incentive scheme applicable for the 2019 financial year was the Performance Share Plan approved by shareholders on 17 May 2017. The Committee has suspended future awards under the 2009 Share Option Plan which remains in place to facilitate the administration of previously granted options.

On 8 March 2019 the Committee, granted an annual award of options to Mr. Rothwell and Mr. Ledwidge in line with the annual limits set out in the PSP rules being 200% and 150% of salary respectively. The total number of options granted to Mr. Rothwell and Mr. Ledwidge based on a share price of €5.00 were 226,000 and 76,500 respectively.

Options Vested during 2019

During the period the Committee considered the performance conditions attaching to the basic tier options granted on 1 September 2014 under the legacy Share Option Plan at an exercise price of €2.97. Under the rules of the Share Option Plan the Committee determined that these grants vested based on reported Group EPS for the year ended 31 December 2018, and accordingly 152,500 outstanding options were deemed vested in favour of participants during the year. None of these options had been granted to the executive Directors. The share price at date of vesting was €4.39.

Options expected to vest during 2020 based on performance to 31 December 2020

The Committee has considered the performance conditions attaching to the second tier options granted on 5 March 2015 under the legacy Share Option Plan at an exercise price of €3.58. Under the rules of the Share Option Plan the Committee has determined that these grants will vest during 2020 based on reported Group EPS for the year ended 31 December 2019. Vesting will be conditional on the continued employment of the option holders at the vesting date. At 31 December 2019 there were 905,000 outstanding second tier options granted on 5 March 2015, including 350,000 and 75,000 options in favour of Mr. Eamonn Rothwell and Mr. David Ledwidge respectively.

The Committee has also considered the performance conditions attaching to the options granted under the PSP on 23 May 2017 which are tested against Group performance up to 31 December 2019. The 2019 outcomes have been adjusted for the effects of the application of IFRS 16 Leases so that the diluted earnings per share, return on average capital employed and free cash flow ratio metrics are comparable over the performance period. The table below shows the expected vesting on each metric.

| Performance Condition | Weighting | Threshold | Maximum | Actual | Outcome |

|---|---|---|---|---|---|

| Diluted adjusted earnings per share | 25% | 36.0 cent | 43.7 cent | 23.7 cent | 0% out of 25% |

| Return on average capital employed | 25% | 13% | 20% | 29.3% | 25% out of 25% |

| Free cash flow ratio | 25% | 100% | 130% | 120.3% | 19% out of 25% |

| Total shareholder return | 25% | 26.8% | 56.5% | 23.3% | 0% out of 25% |

30% vesting occurs at threshold performance increasing pro-rata up to the maximum vesting threshold. Vesting will be conditional on the continued employment of the option holders at the vesting date in 2020. At 31 December 2019 there were 1,036,145 outstanding options granted on 23 May 2017, including 293,000 and 100,000 options in favour of Mr. Eamonn Rothwell and Mr. David Ledwidge respectively of which 128,920 and 44,000 are expected to vest during 2020.

The gross value of those options expected to vest in favour of the executive Directors based on performance to 31 December 2019 has been included in the total director remuneration table for year ended based on an estimated share price of €4.51 being the average closing price of an ICG Unit between 1 October 2019 and 31 December 2019.

Details of movements in share options granted to Directors under the Performance Share Plan and the legacy share option plan are set out in the table below:

| Option Type | Date of Grant | 31-Dec-18 | Granted | Vested | Exercised | 31-Dec-19 | Option Price | Earliest Vesting Date | Latest Expiry Date |

|---|---|---|---|---|---|---|---|---|---|

| E. Rothwell | |||||||||

| Unvested | |||||||||

| Second Tier Share Option1 | 5-Mar-15 | 350,000 | - | - | - | 350,000 | 3.58 | 5-Mar-20 | 4-Mar-25 |

| Performance Share Plan2 | 23-May-17 | 293,000 | - | - | - | 293,000 | 0.065 | 5-Mar-20 | - |

| Performance Share Plan3 | 9-Mar-18 | 189,000 | - | - | - | 189,000 | 0.065 | 9-Mar-21 | - |

| Performance Share Plan3 | 5-Mar-19 | - | 226,000 | - | - | 226,000 | 0.065 | 5-Mar-22 | - |

| Vested but not yet exercised | 5-Mar-19 | 350,000 | - | - | 350,000 | 3.58 | - | 4-Mar-25 | |

| 1,182,000 | 226,000 | - | - | 1,408,000 |

| Option Type | Date of Grant | 31-Dec-18 | Granted | Vested | Exercised | 31-Dec-19 | Option Price | Earliest Vesting Date | Latest Expiry Date |

|---|---|---|---|---|---|---|---|---|---|

| D. Ledwidge | |||||||||

| Unvested | |||||||||

| Second Tier Share Option1 | 5-Mar-15 | 75,000 | - | - | - | 75,000 | 3.58 | 5-Mar-20 | 4-Mar-25 |

| Performance Share Plan2 | 23-May-17 | 100,000 | - | - | - | 100,000 | 0.065 | 5-Mar-20 | - |

| Performance Share Plan3 | 9-Mar-18 | 56,500 | - | - | - | 56,500 | 0.065 | 9-Mar-21 | - |

| Performance Share Plan3 | 5-Mar-19 | - | 76,000 | - | - | 76,000 | 0.065 | 5-Mar-22 | - |

| Vested but not yet exercised | 5-Mar-15 | 75,000 | - | - | - | 75,000 | 3.58 | - | 4-Mar-25 |

| 306,500 | 76,000 | - | - | 382,500 | |||||

1. These options are expected to vest during 2020 based on performance to 31 December 2019 and the gross value has been included in the Director remuneration schedule.

2. These options are expected to vest during 2020 at a vesting rate of 44% based on performance to 31 December 2019 and the gross value has been included in the Director remuneration schedule. The delivered shares will be held in trust for a period of 5 years from exercise date.

3. These options will vest and become exercisable three years from the third anniversary of grant in accordance with achievement of the performance conditions set out in the Remuneration Framework table. These options will normally have to be exercised on or shortly after the vesting date and the delivered shares held in trust for a period of 5 years from exercise date.

Other matters

Minimum Shareholding Requirements

The Company encourages individuals to acquire and retain significant shareholdings to align interests of management with those of shareholders. The Company has a minimum shareholding requirement for executive Directors and members of the executive management committee to hold shares to a market value of 300% of base salary within 5 years of date of appointment. The market value of vested options and any shares held under the Company’s restricted share arrangements will count towards determining an individual’s holdings.

The market value of the holdings of executive Directors and Executive Committee at 31 December 2019 as a multiple of salary at that date are shown in the following table:

| Salary multiple held | |

|---|---|

| Eamonn Rothwell | 255.5 times |

| David Ledwidge | 2.2 times |

| Other Executive Management | 7.0 times |

Non–Executive Directors

Non-executive Directors receive a fee which is set by the Committee and approved by the Board. They do not participate in any of the Company’s performance award plans or pension schemes. As part of the overall review of remuneration structures the Committee recommended the fee payable to the Board Chairman to continue the same as prior year at €125,000 per annum and other non-executive Directors at €50,000. The fee levels are considered in line with market norm generally and reflective of the levels of commitment expected from persons holding non-executive directorship positions.

Non-executive Directors do not have notice periods and the Company has no obligation to pay compensation when their appointment ceases. The letters of appointment are available for inspection at the Company’s registered office during normal business hours and at the AGM.

Director’s Service contracts

Non-executive Directors have been appointed under letters of appointment for periods of three years subject to annual re-election at the AGM.

In respect of Mr. Eamonn Rothwell, CEO, there is an agreement between the Company and Eamonn Rothwell that, for management retention reasons, in the event of a change in control of the Company (where over 50% of the Company is acquired by a party or parties acting in concert, excluding Eamonn Rothwell) he will have the right to extend his notice period to two years or to receive remuneration in lieu thereof.

This amendment to Mr. Eamonn Rothwell’s contract of employment was agreed by the Remuneration Committee a number of years ago to retain and motivate the CEO during a series of attempted corporate takeover actions.

The letters of appointment for other executive Directors do not provide for any compensation for loss of office other than for payments in lieu of notice and, except as may be required under Irish law, the maximum amount payable upon termination is limited to 12 months equivalent.

On termination, outstanding options may at the absolute discretion of the Committee be retained by the departing individual in accordance with the good leaver / bad leaver provisions of the relevant plan. Any shares delivered to an individual which are subject to a retention period will remain unavailable to the individual until the end of the retention period and where applicable will be subject to clawback under the provisions of the Clawback Policy.

Share option schemes

There were no long-term incentive plans in place during the year other than the Group’s 2009 share option plans (suspended as regards new grants) and the Performance Share Plan.

The purpose of the share option plans is to encourage identification of option holders with shareholders’ longer-term interests. Under the plans, options have been granted both to Directors and to employees of the Group. The options were granted by the Committee on a discretionary basis, based on the employees expected contribution to the Group in the future. Non-executive Directors are not eligible to participate in the plan.

In the ten year period ended 31 December 2019, the total number of options granted, net of options lapsed amounted to 3.8% of the issued share capital of the Company at 31 December 2019.

A charge is recognised in the Consolidated Income Statement in respect of share options issued to executive Directors. The charge in respect of executive Directors for the financial year ended 31 December 2019 is €901,000 (2018: €845,000).

Clawback Policy

The Committee recognises that there could potentially be circumstances in which performance related pay (either annual bonuses, and/ or longerterm incentive awards) is paid based on misstated results or inappropriate conduct resulting in material damage to the Company. Whilst the Company has robust management and internal controls in place to minimise any such risk, the Committee has in place formal clawback arrangements for the protection of the Company and its investors. The clawback of performance related pay comprising the annual bonus and PSP awards would apply in certain circumstances including:

- a material misstatement of the Company’s financial results;

- a material breach of an executive’s contract of employment;

- any wilful misconduct, recklessness, and / or fraud resulting in serious injury to the financial condition or business reputation of the Company.

For executive Directors and members of the Executive Committee 50% of the annual bonus will be invested in ICG equity which must be held for a period of five years and one month, which will be subject to clawback for a period of two years per the circumstances noted above. Any awards granted under the PSP will be subject to clawback during the vesting period and any shares delivered on vesting will be subject to clawback for an initial two year period per the circumstances noted above.

Post-employment holdings

The Committee in designing its performance pay initiatives, as explained below, has ensured that executive Directors and senior managers retain appropriate levels of shareholding post-employment. To avoid any conflict with how these schemes operate the Committee does not consider it necessary to specify actual levels of post-employment shareholdings. Under the annual bonus scheme a minimum of 50% of an annual award must be invested in shares held in trust for a holding period of five years. Similarly any shares delivered pursuant to the vesting of options under the PSP must normally be held in trust for a holding period of five years. Therefore, at termination executive Directors and senior management participating in these schemes will contractually retain an interest in shares for a period of five years post employment, proportional to the amount of variable pay awarded over the final five years of employment.

External Appointments

No executive Director retained any remuneration receivable in relation to external board appointments.

Payments to former Directors

There were no pension payments or other payments for loss of office paid to any former Directors during the year.

External Advisers

The Committee sought assistance from Mercer in relation to assessment of the achievement of the performance conditions applicable to the May 2017 awards under the PSP. Mercer are members of the Remuneration Consultants Group and signatories to its Code of Conduct. Other than the services above Mercer did not provide any other services to the Group in the period 1 January 2019 to the date of this report.

Say on Pay

ICG is an Irish incorporated company and is not subject to the UK disclosure requirements of the Large and Medium-sized Companies and Groups (Accounts and Reports) (Amendment) Regulations 2013. However, in accordance with ICG’s commitment to best corporate governance practices and shareholder engagement, the Board, on the recommendation of the Remuneration Committee, will put this Report of the Committee to an advisory vote at the forthcoming 2020 AGM of the Company.

At the AGM held on 17 May 2019, the advisory resolution on the Report of the Remuneration Committee in respect of the year ended 2018 received 78% support. The Company had engaged extensively with its major shareholders in advance of the meeting in respect of their concerns. There is also the opportunity for shareholders to raise any concerns regarding remuneration practices at investor meetings or to request direct communication with the Chair of the Committee.

The Committee understands the following were the concerns of shareholders;

CEO performance pay:

A number of shareholders raised the non-disclosure of metrics around the CEO performance pay. The Committee has considered this and for contractual reasons does not disclose the exact calculation methodology. The Committee is satisfied that the outcomes reflect Group performance over the longerterm. The Committee is of the view that remuneration should be aligned with the business needs and strategy of the Group. Notwithstanding the Committee has also satisfied itself that the total overall remuneration of the CEO is not out of alignment with market norms through comparison with CEO remuneration of FTSE 250 companies and overall Group performance versus the FTSE 250. The Group equity is premium listed on the London Stock Exchange though it is not a constituent of the FTSE 250. However, the Committee is of the view that comparison against FTSE 250 metrics is appropriate as the Group is of an equivalent market capitalisation and provides a large verifiable population for comparative purposes.

| Salary Comparison 2018 | Single figure total remuneration (Average 2016 to 2018) | ||

|---|---|---|---|

| FTSE 250 (excl. top 50) | FTSE 250 | ||

| €000 | €000 | €000 | |

| FTSE 250 CEO | |||

| Lower quartile | 557 | 1,181 | 1,300 |

| Median | 615 | 1,787 | 1,963 |

| Upper quartile | 706 | 2,753 | 2,928 |

| ICG CEO | 552 | 2,681 | 2,681 |

The table above sets out the single figure total remuneration comparison versus FTSE 250 and is based on most recent available information on published accounts for years ended during 2018 sourced from the Deloitte publication “Directors’ Remuneration in FTSE 250 Companies”. The single figure total remuneration figure has been averaged over three years to reduce any single year effect. Sterling figures were converted to Euro at average rates. The Committee notes that the 2018 CEO base salary was within the lower quartile range whereas the single figure total remuneration average over the three year period 2016 to 2018 was ahead of the median but below the upper quartile. The ICG CEO single figure total remuneration average over 2017 to 2019 was €2,925,000, for which there was no publicised comparison available at the date of the report.

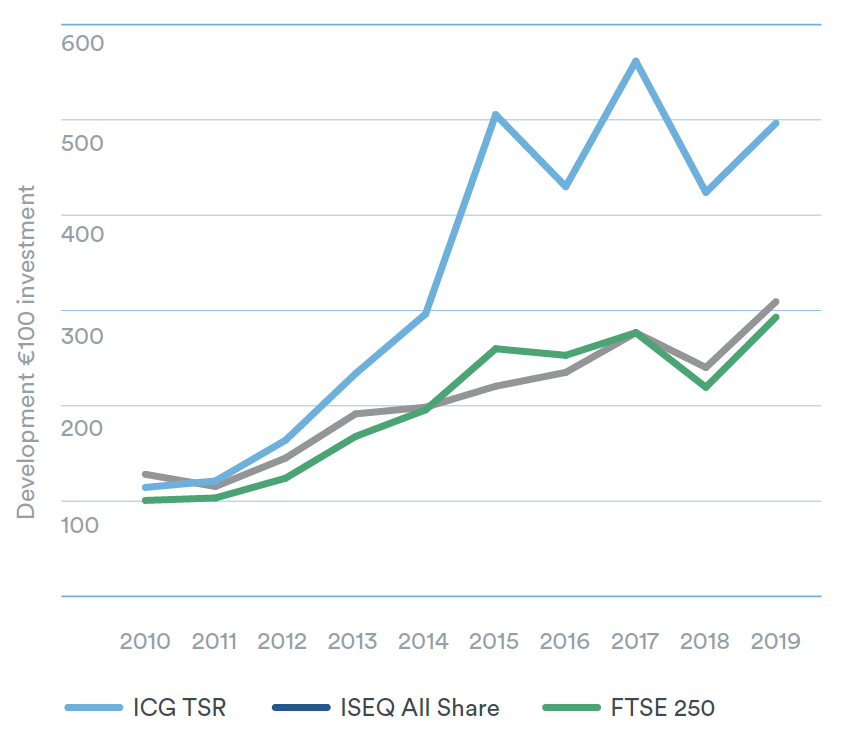

The Committee also considered the longer-term total shareholder return (TSR) performance of the Group compared to both the FTSE 250 and ISEQ all share index based on an initial €100 investment on 1 January 2010 depicted in the chart below.

Comparative TSR Performance

Based on the above analysis the Committee is satisfied the overall remuneration outcomes for the CEO are consistent with the remuneration framework objectives.

CFO rate of salary increase

A number of shareholders raised a concern regarding the 20% increase in the CFO salary in 2018 over 2017. This was viewed as not being consistent with increases awarded generally. Mr. Ledwidge was appointed to the position of CFO in March 2015 and to the Board in March 2016. The Committee had noted in its 2016 report that Mr. Ledwidge’s salary was set at a level commensurate with his experience with the Group with the expectation that subject to individual and Group performance that this level of salary will rise progressively over a number of years to comparable levels in the market for similar roles. The Committee has assessed Mr. Ledwidge’s performance since 2016 to have met its expectations and has increased his salary progressively from an initial salary on appointment to the Board of €160,000 to €254,000 reported in this report. The Committee has further determined that his salary be set at €318,000 for 2020. In setting this salary level the Board has again looked at FTSE 250 salary levels for equivalent positions as set out below;

| Salary Comparison 2018 | Single figure total remuneration (Average 2016 to 2018) | ||

|---|---|---|---|

| FTSE 250 (excl. top 50) | FTSE 250 | ||

| €000 | €000 | €000 | |

| FTSE 250 CFO | |||

| Lower quartile | 363 | 750 | 821 |

| Median | 408 | 1,086 | 1,139 |

| Upper quartile | 461 | 1,546 | 1,619 |

| ICG CFO | 221 | 448 | 448 |

The Committee notes that the prior year’s salary levels and the 2020 level remain at the lower quartile levels as does the single figure total remuneration. In line with the objectives of the Remuneration Framework, and having reviewed Mr. Ledwidge’s performance the Committee is satisfied that the progressive increase in the salary level remains appropriate.

Market price of shares

The closing price of the shares on Euronext Dublin on 31 December 2019 was €4.84 and the range during the year was €3.71 to €5.20.

Brian O’Kelly

Chair of the Remuneration Committee