Fleet Summary

Operated by Ferries division

| In operation | Type | Employment |

|---|---|---|

| Ulysses | Cruise ferry | Dublin – Holyhead |

| Isle of Inishmore | Cruise ferry | Rosslare – Pembroke |

| Epsilon (chartered-in) | Ropax* | Dublin – Holyhead / Cherbourg |

| Dublin Swift | High Speed Ferry | Dublin – Holyhead |

| W.B. Yeats | Cruise ferry | Dublin – Holyhead / Cherbourg |

| Under construction | ||

| Hull 777 | Cruise ferry | Contracted delivery end 2020 |

Chartered out by Ferries division

| Vessel | Type | Employment |

|---|---|---|

| Ranger | LoLo container vessel | Charter – 3rd Party |

| Elbfeeder | LoLo container vessel | Charter – Inter-Group |

| Elbtrader | LoLo container vessel | Charter – Inter-Group |

| Thetis D | LoLo container vessel | Charter – 3rd Party |

| CT Rotterdam | LoLo container vessel | Charter – Inter-Group/3rd Party |

| Elbcarrier | LoLo container vessel | Charter – Inter-Group |

*A Ropax ferry is a vessel with RoRo freight and passenger capacity.

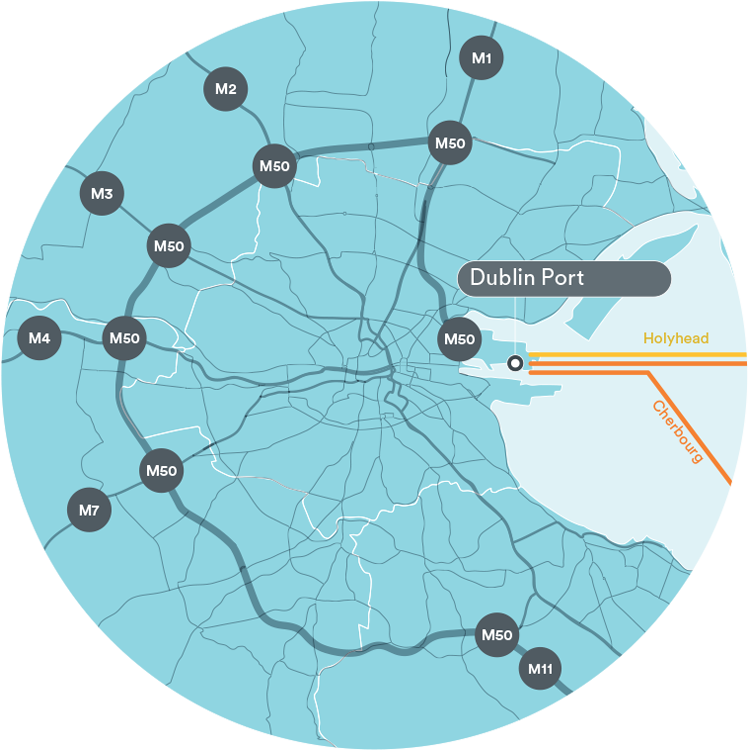

The ferry services trades under the Irish Ferries brand. During 2019 Irish Ferries operated three routes utilising a fleet of five vessels, four of which are owned and one which is chartered-in.

The division took delivery in December 2018 of the new cruise ferry the W.B. Yeats. After undergoing final commissioning and certifications it commenced services on the Dublin – Holyhead route in January 2019 transferring to the Dublin – Cherbourg route in March. In April 2019, the Group entered into a bareboat hire purchase agreement for the sale of the surplus vessel Oscar Wilde to MSC Mediterranean Shipping Company SA. The Dublin Swift fastcraft re-entered service in March 2019 following winter layup and drydock during which the car carrying capacity was increased through the addition of a new mezzanine deck.

In addition to the modern fleet Irish Ferries retains rights to access appropriate berthing times at key ports allowing Irish Ferries to facilitate its customer preferred sailing times.

The division also owns six container vessels which are time chartered.

Revenue in the division was 8.3% higher than the previous year at €212.4 million (2018: €196.2 million). Revenue in the first half of the year increased by 1.5% to €92.3 million (2018: €90.9 million), while in the second half revenue increased 14.1%, to €120.1 million (2018: €105.3 million). EBITDA increased to €67.2 million (2018: €53.6 million) while EBIT was €36.4 million compared with €34.2 million in 2018.

The prior year reported figures have not been restated for the effects of IFRS 16 adopted on 1 January 2019. Adjusting the 2019 reported figures for these effects, the underlying comparatives for 2019 are EBITDA of €61.3 million, a 14.3% increase over 2018 and EBIT of €36.2 million, an increase of 5.8% over 2018.

Fuel costs were €34.7 million, an increase of €1.0 million on the prior year. The division achieved a return on capital employed of 17.6% or 17.4% pre IFRS 16 (2018: 31.1%).

In total Irish Ferries operated 4,934 sailings in 2019 (2018: 4,755), the increase mainly due to technical issues on the vessel Ulysses in the prior year which resulted in a cancellation of sailings.

2019 Overall Ferries division Performance

| As Reported | Pre IFRS 16 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2018 | Change | 2019 | Change | ||||||

| Revenue | €212.4m | €196.2m | +8.3% | €212.4m | +8.3% | |||||

| EBITDA* | €67.2m | €53.6m | +25.3% | €61.3m | +14.3% | |||||

| EBIT* | €36.4m | €34.2m | +6.4% | €36.2m | +5.8% | |||||

| Non-trading item | €14.9m | €13.7m | - | €14.9m | - | |||||

| ROACE | 17.6% | 31.1% | - | 17.4% | - | |||||

* Excluding non-trading items.

Irish Ferries Ropax and Cruise ferry Services |

Irish Ferries High Speed Ferry |

Car and Passenger Markets

It is estimated that the overall car market*, to and from the Republic of Ireland, fell by approximately 2% in 2019 to 777,600 cars, while the all-island market, i.e. including routes into Northern Ireland, is estimated to have decreased by 1.0%. Irish Ferries’ car carryings during the year were up on the previous year by 2.2% to 401,300 cars, (2018: 392,700 cars). In the first half of the year Irish Ferries car volumes fell by 6.0%, reflecting the planned withdrawal of fastcraft services in the winter period. In the second half of the year, volumes were up by 8.3%, largely attributable to the disruption of services of the Ulysses in 2018 and additional conventional ferry services on the Dublin – Holyhead route due to the introduction of the W.B. Yeats.

The total sea passenger market (i.e. comprising car, coach and foot passengers) to and from the Republic of Ireland decreased by 3.5% on 2018 to a total of 2.92 million passengers, while the all-island market decreased by 1.5%. Irish Ferries’ passenger numbers carried increased by 2.6% at 1.54 million (2018: 1.50 million). In the first half of the year, Irish Ferries passenger volumes fell by 4.7% and in the second half of the year, which is seasonally more significant, the increase in passenger numbers was 8.5%.

The Ferries division delivered 92% of scheduled sailings compared with 86% in the previous year across all services. Our conventional ferry services (excluding the fast ferry) delivered schedule integrity of 97% in comparison with 90% in 2018. These figures largely reflect lost sailings arising from the technical issues affecting the Ulysses in the prior year and non-operation of scheduled W.B. Yeats sailings in 2018 due to the late delivery of that vessel by the shipbuilder.

Initiatives by the tourist industry such as the Wild Atlantic Way and Ireland’s Ancient East, have been instrumental in promoting ‘own car’ tourism around the Irish coasts, and have helped broaden the distribution of tourists around the island and across the seasons.

In 2019, Irish Ferries delivered a comprehensive programme of marketing and promotional activity across our key markets of Britain, Ireland and France. We continued investing significantly in our brand and delivered compelling and personalised offers to our customers at times relevant for the planning and booking of their holidays and other travel.

This approach helped to improve our brand awareness in these important markets, and to drive increased levels of enquiries to our website, www.irishferries.com, which generated over 6.4 million visits, and delivered over 85% of bookings transacted in the year.

Our campaign strategy was to deliver awareness of our services, using traditional and social media channels and to create an interest in purchasing our services online. We used the latest buying techniques to leverage the best value in our media spend and delivered an integrated campaign across the relevant markets. Our messaging and advertising used a wide range of channels and was compatible with all transactional platforms, browsers and devices, in support of our strategy of being available to our customers whenever they wish to book, and on whatever device they choose to do so.

We appreciate that our own performance is closely linked to the performance of tourism source markets, and we continued to work closely with state tourism agencies in Ireland (Tourism Ireland & Fáilte Ireland), Wales (Visit Wales), and France (Normandy Tourism and Cotentin Tourism), to deliver co-operatively funded advertising and publicity initiatives.

Given the commercial value of our e-commerce site, considerable attention is paid to ensuring that the associated systems are continuously available, robust and secure. We continue to invest in developing our e-commerce efficiency and are continuously updating our systems and channels as we determine changes in consumer research and transaction behaviour.

While we work hard to engage with the consumer marketplace, we also invest considerably in partnerships with the travel trade. In 2019, we were delighted to be voted ‘Best Ferry Company’ by travel trade professionals, for the 9th year in a row at the Irish Travel Industry Awards, and for the 13th year in a row at the Irish Travel Trade News Awards. In addition, in the UK Group Leisure & Travel awards, Irish Ferries was voted the winner in the category 'Best Ferry or Fixed Link Operator’.

Already this year, Irish Ferries has been awarded ‘Best Ferry Company’ for the 10th year in succession by travel agents in the Irish Travel Industry Awards 2020.

RoRo Freight

The RoRo freight market* between the Republic of Ireland, and the U.K. and France, continued to grow in 2019 on the back of the Irish economic recovery, with the total number of trucks and trailers up 1.0%, to approximately 1,042,800 units. On an all-island basis, the market increased by approximately 0.8% to 1.88 million units.

Irish Ferries’ carryings, at 313,200 freight units (2018: 283,700 freight units), increased by 10.4% in the year with volumes up 7.4% in the first half and up 13.5% in the second half. The performance against the market is principally related to the schedule disruptions experienced on the Ulysses in the prior year and additional sailings and capacity following the introduction of the W.B. Yeats.

Irish Ferries has also been proactive in the online environment for freight customers. In recent years high quality mobile options have been developed, alongside the traditional desktop, whereby customers can access our freight reservations systems with ease. This has facilitated an increasing proportion of our business being booked via our website, www.irishferriesfreight.com.

*(Market figures source: Passenger Shipping Association and Cruise & Ferry)

Chartering

During the year, the Group purchased two additional container ships for external charter. The Thetis D was purchased in April for €12.4 million, and the CT Rotterdam was purchased in November for €8.2 million. Of our six owned LoLo container vessels, three are currently on yearlong charters to the Group’s container shipping subsidiary Eucon on routes between Ireland and the continent whilst two are chartered to third parties. The remaining vessel, the recently acquired CT Rotterdam, is providing short-term drydock cover with Eucon and will afterwards be offered to the market. Overall external charter revenues were €4.7 million in 2019 (2018: €2.1 million).

In April 2019, the Group entered into a bareboat hire purchase agreement for the sale of the Oscar Wilde to MSC Mediterranean Shipping Company SA.

Outlook

We look forward to 2020 and beyond with renewed confidence in our service offering. With the addition of the W.B. Yeats to the fleet we are now able to offer a year round freight service direct to Cherbourg with additional significant capacity in both tourism and freight offerings. With the extensive drydocking works carried out on the Ulysses at the beginning of the year, we have returned to previously high levels of schedule integrity and we plan to build on this in the coming year.