John B. McGuckian

In this section:

- A Focus on Purpose

- Enhancing Board effectiveness

- Board Changes

- Monitoring culture

- Creating value for stakeholders

- UK Corporate Governance Code

- Corporate Governance Code

- Corporate Governance Framework

- Stakeholder Engagement

- Division of Responsibilities

- Composition, Succession and Evaluation

- Audit Risk and Internal Control

- Reporting

- Remuneration

- Diversity

- Matters Pertaining to Share Capital

Dear Shareholder,

As the coronavirus pandemic has continued to impact on society, the Board has overseen the consideration of stakeholder needs and experiences, and the integration of these throughout work and discussions in the Boardroom. This approach reflects the Board’s focus on embedding high standards of corporate governance, with the objective of providing a transparent and engaging account of our approach throughout our Annual Report.

A Focus on Purpose

Our purpose – to achieve continued success in our chosen markets, delivering a safe, reliable, timely, good value and high-quality experience to our customers in a way that minimises our impact on the environment – has guided actions at every level of the organisation throughout the year. In the immediate term, this meant a relentless focus on the health and safety of our employees, customers and wider stakeholders. With a longer-term view, it has resulted in significant efforts to review our impact on the environment and, where possible, go above and beyond the significant changes to the regulatory environment for shipping. The pandemic has not distracted from the challenges presented by climate change and ICG will continue to do its utmost to reduce the impact it has on the environment. As part of those efforts, we have for the first time set out a plan for net zero in our land-based operations, with further details set out on page 45.

Enhancing Board effectiveness

Social distancing guidelines have resulted in significant changes to the way we work and engage. One of our priorities during FY2021 was to ensure the Board continues to operate at a highly effective standard. With the inability to meet physically, a comprehensive engagement programme has drawn on technology to create new platforms for conversations. While not a direct substitute for in-person discussion, these have been successful in ensuring the connectivity and collaboration necessary to ensure the effective functioning of the Board and senior leadership.

While we had deferred the external Board evaluation during 2020 due to the challenges facing society and the business, it took place during 2021. The evaluation showed that the Board and each of its Committees continue to operate effectively. The value of external evaluations lies in ensuring the Board consistently tests itself and always strives to improve. Further details of the evaluation are set out on pages 88 to 89.

Board Changes

There were two additions to the Board in the year. On 4 January 2021, Lesley Williams joined the Board, followed by Dan Clague on 26 August 2021. We are fortunate to have been able to add such impressive individuals to our Board. While each possess many talents, Lesley’s capital markets and ESG expertise will be relevant, with Dan’s knowledge at the intersection of investment banking, transport and infrastructure already adding significant depth of expertise to the Board. For the first time, we have also provided a skills matrix for our Directors, which will inform succession and Board refreshment plans, as well as the requirements for Board development and learning.

Catherine Duffy and Brian O’Kelly stepped down during 2021 and we are grateful for their contribution throughout their tenure. Following these changes, the Board is fully aware that the composition of the Board does not align with the ambitions set by the Hampton-Alexander Review and, closer to home, targets from the Balance for Better Business. As a Board, we recognise the benefits of diversity and through the Nomination Committee, we place a particular focus on ensuring any candidate pool for Board or senior management positions provides the Board an opportunity to promote diversity within the Board and senior team.

Monitoring culture

As a Board, we have welcomed the growing focus on the idea of culture within businesses from investors and regulators. One of the key tests of the past 12 months has been the resilience of employees and business’ culture. While there has been significant upheaval in our sector, given the focus on safety throughout the business, we were probably positioned better than most to respond to the evolving requirements of a pandemic and associated regulation. The impact of coronavirus on the metrics that depict our culture will be monitored closely as we progress through 2022, alongside actions to reiterate broader cultural expectations. One of the most meaningful means of understanding culture, and subsequently taking steps to drive enhancements, is direct feedback from employees at all levels of the organisation. With this in mind we will be undertaking a new program to engage our employees with talent development.

Creating value for stakeholders

While the requirements of the UK Code apply to Irish businesses, certain aspects of its framework are based on UK legislation. Once such aspect is provision 5 of the 2018 Code, which sets out the expectation that the Board details how stakeholder interests have been taken into account. Nonetheless, while section 172 of the UK Companies Act does not directly apply to ICG, stakeholder interests have never been in sharper focus, and the importance of Environmental, Social and Governance (ESG) matters to investors continues to grow at pace. To ensure the Board remains in touch with material issues and concerns, it has increased the resources dedicated to sustainability practices, and has put in place a more robust reporting framework that takes into account stakeholder interests. The Board’s annual review of sustainability priorities reflects our wider social contract, which in 2021 saw the adoption of an environmental policy, a complete revision of many existing policies and, our inaugural reporting against SASB standards for our industry and the commencement of our disclosure against the TCFD. Work is also continuing as part of the review of all governance documentation, to ensure the most material risks and opportunities are elevated to the highest parts of the organisation, with material non-financial data being integrated into the same risk management and KPI framework as its financial counterparts.

UK Corporate Governance Code

I am pleased to report that we applied the provisions of the 2018 UK Corporate Governance Code (the ‘2018 Code’) during the year. In those limited instances where compliance was not achieved in the specific circumstances of the Group, we have provided explanation. Details of our compliance, the composition of our Board, its corporate governance arrangements, processes and activities during the year, and reports from each of the Board’s Committees, are set out on the following pages.

Finally, I would like to thank all of our shareholders for their continued support, and I look forward to welcoming you to our AGM on 11 May 2022. The Board will be available to answer any questions you may have about the business of the meeting.

John McGuckian

Chairman

9 March 2022

Corporate Governance Code

The Group is committed to the principles of corporate governance contained in the UK Corporate Governance Code (the Code) issued in July 2018 by the Financial Reporting Council, as adopted by Euronext Dublin, for which the Board is accountable to shareholders. The Irish Corporate Governance Annex (the Irish Annex) issued by Euronext Dublin also applies to the Group.

This Corporate Governance Report presented in the context of the full Annual Report and Financial Statements for the year ended 31 December 2021 sets out how the Board has applied the Principles of the Code. This is supported through reporting on compliance with the Provisions of the Code. The Board considers that, other than for the deviations noted below which have been explained in this Corporate Governance Report, throughout the period under review the Group has been in compliance with the provisions of the Code and the requirements set out in the Irish Annex.

Provision 5 of the Code requires the Board to describe in its Annual Report how the interests of key stakeholders and the matters set out in Section 172 of the United Kingdom Companies Act of 2006. While that Act does not apply to Irish companies, the Board is satisfied that these matters have been addressed in discussions and disclosures throughout this Annual Report including discussion on strategy and business model, business review, risk processes, environmental matters and stakeholder engagement. Provision 5 also requires that employee engagement be facilitated by one of three prescribed methods. As the Board has not chosen one or more of these methods, it explains at page 84 the alternative arrangements which are in place and why it considers that they are effective. Under Provision 19 of the Code, the Chair should not remain in post beyond nine years from the date of their first appointment. This report at page 87 provides details to the continuing tenure of Mr. John B. McGuckian as Chairman beyond nine years.

Provision 36 requires that the Remuneration Committee should develop a formal policy for post-employment shareholding requirements encompassing both unvested and vested shares. The Report of the Remuneration Committee at page 113 sets out the reasoning for not establishing a formal policy given that the existing arrangements under the Remuneration Policy result in contractual restrictions on share disposals of up to five years post-employment.

Provision 39 requires that notice or contract periods should be one year or less. The Report of the Remuneration Committee at page 112 sets out why in relation to one Director a notice period of two years will apply in certain circumstances.

Corporate Governance Framework

Board Leadership and Company Purpose

The Board is collectively responsible for the long-term sustainable success of the Group through provision of leadership within a framework of prudent and effective controls which enables risk to be assessed and managed. Pursuant to the Constitution, the Directors of the Company are empowered to exercise all such powers as are necessary to manage and run the Company, subject to the provisions of the Companies Act 2014.

In discharging this responsibility, the Board has adopted a formal schedule of matters specifically reserved to it for decision, which covers key areas of the Group’s business including approval of financial statements, budgets (including capital expenditure), acquisitions or disposals of significant assets, dividends and share redemptions, board appointments and setting the risk appetite. Certain additional matters are delegated to Board Committees.

In discharging their duties, the Board has arrangements in place for Directors to disclose any direct or indirect interests which may possibly conflict with the interests of the Company.

Group Strategy and Corporate Governance

On page 18 we describe the Group’s strategy. This strategy is supported by our five strategic pillars, consideration of which is interwoven throughout the Board agenda for each meeting and throughout this report.

Strategic pillar | Key activities during the period |

Quality service | |

Investment in quality assets is essential to ensure a reliable, timely and high-quality service to our customers which is essential to retaining the Group’s pivotal position in international logistics chain and to driving growth in the Group’s business. |

|

People and culture | |

Our customers’ experience is directly affected through their interaction with our employees and third-party contractors. |

|

Financial management | |

Pursuit of investment opportunities within stringent risk and reward hurdles, avoidance of speculative financial positions and Capital management. |

|

Safety | |

The operational safety of our vessels and terminal facilities is paramount to maintaining the reputation of our brands which is vital to future success and a strong safety culture is promoted across all activities. |

|

Sustainability | |

The Group seeks to minimise the impact of its activities on the environment through constant innovation, efficiency and awareness. |

|

Stakeholder Engagement

At Irish Continental Group, we believe success in our business will deliver sustained and profitable growth for the benefit of all our stakeholders. To nurture this success regular dialogue takes place at relevant levels within the Group and feedback is delivered to the Board through the CEO and presentations from the senior executive team.

Shareholders

The Board acknowledges its responsibility to engage with shareholders to ensure that their interests are being met and to listen to any areas of concern which they may raise.

The Board encourages communications with shareholders and welcomes their participation at all general meetings of the Company. While it was not possible to accommodate physical attendance at the 2021 AGM due to government restrictions on gatherings imposed due to Covid-19, the Company provided a live audio feed and a facility to submit questions in advance of the meeting.

Regular formal updates are provided to shareholders and are available on the Group’s website. During 2021, these included Trading Updates, the Half-Yearly Financial Report, and the Annual Report and Financial Statements together with investor presentations. Irish Continental Group’s website, www.icg.ie, also provides access to other corporate and financial information, including all regulatory announcements and a link to the current ICG Unit price.

Other than during close periods and subject to the requirements of the Takeover Code, when applicable, the Chief Executive and the Chief Financial Officer have a regular dialogue with its major shareholders throughout the year and report on these meetings to the Board. The Senior Independent Director is also available on request to meet with major shareholders.

The 2022 Annual General Meeting is scheduled for 11 May 2022. Arrangements will be made for the 2021 Annual Report and 2022 Annual General Meeting Notice to be available to shareholders at least 20 working days before the meeting and for the level of proxy votes cast for and against each resolution and the number of abstentions, to be announced at the meeting. Further details on the procedures applicable to general meetings are set out on pages 91 to 92.

Further investor relations information is available on pages 208 to 209 of this Annual Report.

Workforce

We rely on our workforce to promote our values. Our customers’ experience and consequentially our success is directly affected through their interaction with our workforce comprising our own employees and third-party contractors. In return we recognise our obligation to promote employee development in an environment which promotes diversity and inclusion and provides a safe working environment.

The Board notes the Code provision relating to workforce engagement and the methods which might be used to effect same. The Board has considered these against the nature of the manner in which the Group’s activities are performed. As is common practice in the maritime sector, our vessels are crewed through third-party managers. The Group has no legal rights to engage with the individual crew members who are directed and controlled by the third-party manager. The contracts between the Group and the crewing managers include detailed service level arrangements and requirements that the third-party adhere to international IMO regulations regarding employment terms for seafarers. The Group monitors the crewing manager certification on an ongoing basis. The Group has also entered into third-party labour contracts with respect to its terminal operations.

At peak season, the Group engages in excess of 1,000 persons, of which approximately 300 are direct employees. The Board has considered that the most appropriate manner in which it can ensure that the interests of persons employed directly or indirectly can be considered is through challenging the CEO and divisional managing directors on their regular reports to the Board.

Both formal and informal processes underlie engagement with the direct workforce. Formal processes include general briefing sessions to all employees through the management chain. There are also annual staff reviews which promote the exchange of views. The Group has also formulated grievance and whistleblowing procedures whereby employees can report any concern in confidence. The Group also has arrangements in place for the provision of confidential counselling services. Informally, given the small direct workforce, there is an open access policy whereby any employee has access to any manager up to the CEO. Senior management also regularly visit all Group locations. Within these processes, executive management report on workforce matters to the Board.

Site visits are also arranged for Board members. However, during the Covid-19 pandemic these were curtailed in line with Group safety protocols to limit unnecessary contacts.

Customers

Our strategy centres around meeting our customers maritime transport requirements whether that is being a key partner in their organisation’s international logistics chain or personal travel arrangements. We engage with our customers on a daily basis through the provision of our services but also proactively work in partnership with our customers so that they can achieve their objectives. Through listening to our customer feedback and requirements we adapt our offering in the provision of safe, reliable, timely, good value and high quality maritime transport, while continuing initiatives to minimise the impact of our operations on the environment. The Board receives regular updates from the CEO and senior managers on customer performance and market developments.

Suppliers

The Group’s partnerships with its suppliers are essential to the Group’s success in delivering its services. We work closely with our suppliers to ensure the quality of supplies and services meet our exacting requirements. We support our suppliers with their innovation projects which benefit the way we can deliver our services. Increasingly this involves initiatives with an environmental benefit whether it be a new or improved product or a new way of doing things. We have in place a Supplier Code of Conduct which purpose is to ensure our procurement processes are aligned with our values and policies across the areas of environment, ethics, human rights and health and safety. The Board receives regular updates from the CEO and senior managers on the performance of key suppliers and innovations.

Environment and Society

The Group acknowledges its societal responsibility to conduct business in a manner that protects our shared environment. We operate in a highly regulated industry which requires adherence to high standards of waste and resource management, pollution prevention and increasingly rigorous compliance measures to reduce greenhouse gas emissions across the maritime sector. This involves continuous engagement with port and flag state authorities, industry representative bodies, and local and international regulatory agencies. A key step in the Group’s climate change risk framework outlined on pages 64 to 66 is to engage in a research program to incorporate stakeholder views on the environment and climate change expectations into the Group’s risk appetite setting and strategic planning processes.

ICG is recognised as a critical infrastructure operator in providing essential transport services under the Irish Ferries and Eucon brands. This requires collaboration with the Irish government on areas of business continuity and network and information security. Irish Ferries is also a significant contributor to the tourism industries of Ireland, the UK and France and engages in co-operative campaign programs with regional tourism bodies to promote local tourism.

We also support various community initiatives and charities that align with our strategic pillars of safety and sustainability.

Division of Responsibilities

The Board comprises of two executive and four non-executive Directors. The roles of Chairman and Chief Executive are separate, set out in writing and approved by the Board.

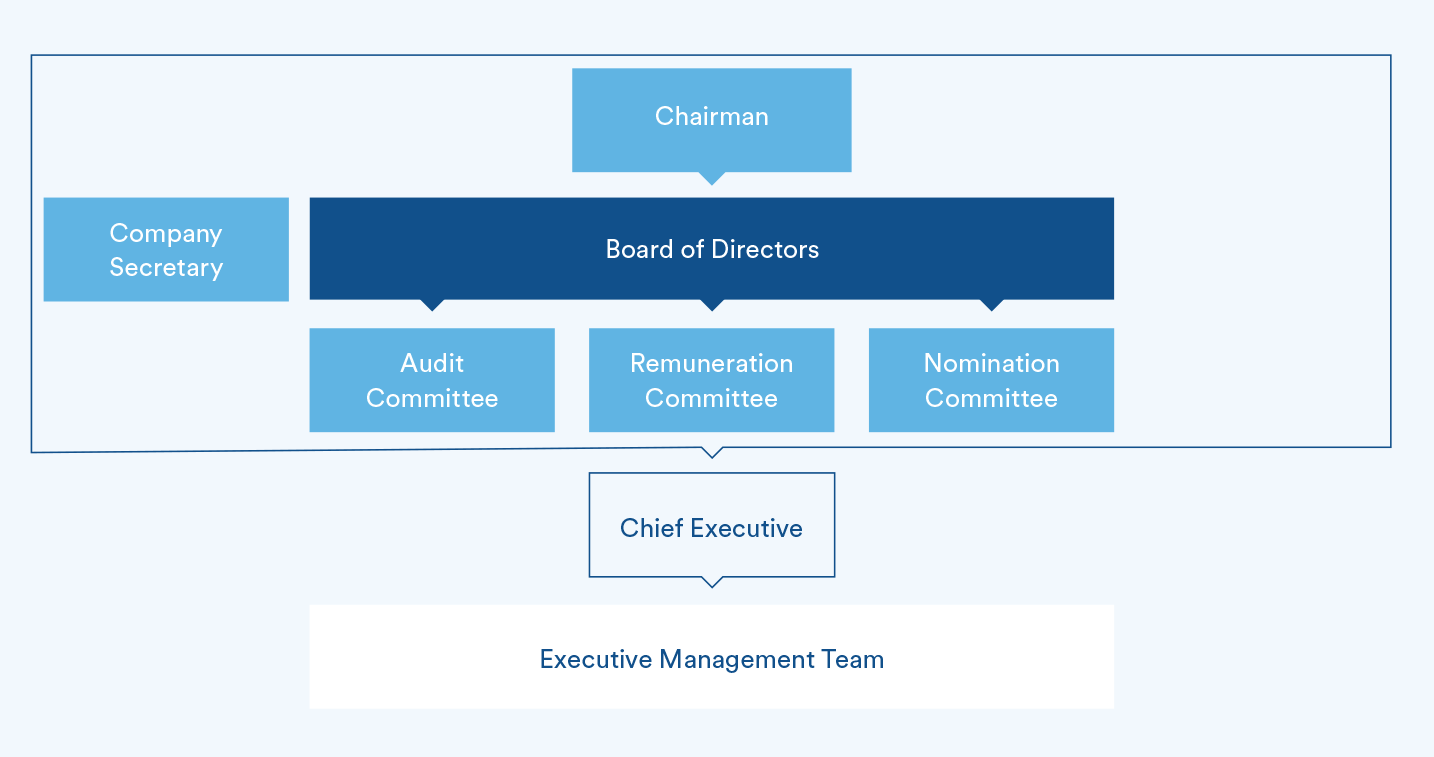

The Board has adopted the corporate governance structure set out below which it believes provides for segregation of the oversight functions from those of executive management.

Chairman: The Board is led by the Chairman who is responsible for its overall effectiveness in directing the Group.

John B. McGuckian has served as Chairman of the Board since 2004 and is responsible for leading the Board, ensuring its effectiveness through;

- Setting the Board’s agenda and ensuring that adequate time is available for discussion.

- Promoting a culture of openness and debate by facilitating the effective contribution of non-executive Directors in particular and ensuring constructive relations between executive and non-executive Directors.

- Ensuring that the Directors receive accurate, timely and clear information.

- Ensuring effective communication with shareholders.

Chief Executive: The Board has delegated the management of the Group to the Executive Management Team, through the direction of Eamonn Rothwell who has served as Chief Executive since 1992. The Chief Executive is responsible for implementing Board strategy and policies and closely liaises with the Chairman and manages the Group’s relationship with its shareholders.

Senior Independent Director: The Board, having considered his experience, appointed John Sheehan as the Senior Independent Director effective from 26 January 2022. The Senior Independent Director acts as a sounding board for the Chairman and serves as an intermediary for the other Directors if necessary. The Senior Independent Director is also available to shareholders if they have concerns which have not been resolved through the normal channels of Chairman, Chief Executive or for which such contact is inappropriate. Brian O’Kelly served as the Senior Independent Director up to his retirement as Director on 17 December 2021.

Non-executive Directors: Non-executive Directors through their knowledge and experience gained outside the Group constructively challenge and contribute to the development of Group strategy. Non-executive Directors scrutinise the performance of management in meeting agreed goals and objectives and monitor the reporting of performance. They satisfy themselves on the integrity of financial information and that financial controls and systems of risk management are robust and defensible. Through their membership of Committees, they are responsible for determining appropriate levels of remuneration of executive Directors and have a prime role in appointing and, where necessary, removing executive Directors, and in succession planning.

Company Secretary: The Company Secretary provides a support role to the Chairman and the Board ensuring good information flows within the Board and its committees and between senior management and non-executive Directors, as well as facilitating induction and assisting with professional development as required and advising the Board through the Chairman on governance matters. Thomas Corcoran has served as Company Secretary since 2001.

Committees: During the year ended 31 December 2021, there were three standing Board Committees with formal terms of reference; the Audit Committee, the Nomination Committee and the Remuneration Committee. In addition, the Board will establish ad-hoc sub-committees to deal with other matters as necessary. All Board committees have written terms of reference setting out their authorities and duties delegated by the Board. The terms of reference are available, on request, from the Company Secretary and are available on the Group’s website. The reports of the committees are set out at pages 94 to 114.

Independence: All of the non-executive Directors are considered by the Board to be independent of management and free of any relationships which could interfere with the exercise of their independent judgement. In considering their independence, the Board has taken into account a number of factors including their length of service on the Board, other directorships held and material business interests.

Mr. McGuckian has served on the Board for more than nine years since his first appointment. Notwithstanding this tenure the Board, as advised by the Nomination Committee, considers Mr. McGuckian to be independent having regard to the independent mindset with which he carries out his role. The Board has considered the knowledge, skills and experience that he contributes and assesses him to be both independent in character and judgement and to be of continued significant benefit to the Board. Mr McGuckian was also assessed to be independent at the date of appointment as Chairman in 2004. While conscious of the recommendations of the UK Code, the Board – through the Nomination Committee – considered it in the best interests of the Company and its stakeholders for the Chair to continue for 2022. Mr. McGuckian extensive knowledge of the business ensures appropriate challenge and leadership of the Board during this time of strategic development and continuing risk of the Covid-19 pandemic.

Meetings: The Board agrees a schedule of regular meetings each calendar year and also meets on other occasions if necessary with contact between meetings as required in order to progress the Group’s business. Where a Director is unable to attend a meeting, they may communicate their views to the Chairman. The Directors receive regular and timely information in a form and quality appropriate to enable the Board to discharge its duties. Non-executive Directors are expected to utilise their expertise and experience to constructively challenge proposals tabled at the meetings. The Board has direct access to the Executive Management Team who regularly brief the Board in relation to operational, financial and strategic matters concerning the Group.

Director attendances at scheduled meetings are set out below. In addition, there was regular contact and updates between these scheduled meetings. The Chairman also held meetings with the non-executive Directors without the executive Directors present and the non-executive Directors also meet once a year, without the Chairman present.

Attendance at scheduled Board meetings during the year ended 31 December 2021 was as follows:

Member | A | B | Tenure |

J. B. McGuckian (Chair) | 7 | 7 | 34 years |

E. Rothwell | 7 | 7 | 35 years |

C. Duffy (resigned: 12 May 2021) | 3 | 3 | 9 years |

D. Ledwidge | 7 | 7 | 6 years |

B. O’Kelly (resigned: 17 December 2021) | 7 | 7 | 9 years |

J. Sheehan | 7 | 7 | 8 years |

Lesley Williams | 7 | 7 | 1 year |

Dan Clague | 2 | 2 | 0.5 years |

Column A: the number of scheduled meetings held during the year where the Director was a member of the Board.

Column B: the number of scheduled meetings attended during the year where the Director was a member of the Board.

Access to Advice: There is a procedure for Directors in the furtherance of their duties to take independent professional advice, at the expense of the Group, if they consider this necessary. The Group carries director liability insurance which indemnifies Directors in respect of legal actions that may be taken against them in the course of discharging their duties as Directors.

All Directors have access to the advice and services of the Company Secretary, who is responsible to the Board for ensuring that Board procedures are followed and that applicable rules and regulations are complied with.

Composition, Succession and Evaluation

Composition: The Board comprises two executive and four non-executive Directors. Excluding the Chairman, a majority of the Board comprises independent non-executive Directors in line with the recommendation of the Code.

Details of the professional and educational backgrounds of each Director encompassing the experience and expertise that they bring to the Board are set out on pages 78 to 79. The Board believes that it is of a size and structure and that, the Directors bring an appropriate balance of skills, experience, independence and knowledge to enable the Board to discharge its respective duties and responsibilities effectively, with no individual or group of individuals dominating the Board’s decision making. Each of the non-executive Directors has a broad range of business experience independent of the Group both domestically and internationally. The appointments that took place during 2021 further underpinned that diversity of background and experience.

The Board has established a Nomination Committee to lead the appointments process and plan for orderly succession at Board and senior management level. The Nomination Committee report is set out on pages 100 to 101.

Appointments: All Directors are appointed by the Board, following a recommendation by the Nomination Committee, for an initial term not exceeding three years, subject to annual re-election at the Annual General Meeting. Prior to their nomination as a non-executive Director, an assessment is carried out to determine that they are independent. Non-executive Directors’ independence is thereafter reviewed annually, prior to recommending the resolution for re-election at the AGM. Under the Articles each Director is subject to re-election at least every three years but in accordance with the Code, the Board has agreed that each Director will be subject to annual re-election at the AGM.

The terms and conditions of appointment of non-executive Directors appointed after 2002 are set out in their letters of appointment, which are available for inspection at the Company’s registered office during normal office hours and at the AGM of the Company.

During 2021, there were two new non-executive appointments to the Board, Lesley Williams on 4 January 2021 and Dan Clague on 26 August 2021. Both were deemed independent on appointment. Catherine Duffy and Brian O’Kelly resigned as Directors during 2021, both having served nine years as a Director of the Company.

Development and Induction: On appointment, Directors are given the opportunity to familiarise themselves with the operations of the Group, to meet with executive management, and to access any information they may require. Each Director brings independent judgement to bear on issues of strategy, risk and performance. The Directors also have access to the Executive Management Team in relation to any issues concerning the operation of the Group.

The Board recognises the need for Directors to be aware of their legal responsibilities as Directors and it ensures that Directors are kept up to date on the latest corporate governance guidance, company law developments and best practice.

Performance Evaluation: The Board conducts an annual self-evaluation of the Board as a whole, the Board processes, its committees and individual Directors. The purpose of the evaluation process includes identification of improvements in Board procedures and to assess each Director’s suitability for re-election. The process, which is led by the Chairman, is forward looking in nature. On a triennial cycle an independent external facilitator is engaged to further assist the process, though this engagement was deferred from 2020 to 2021 due to Covid-19 considerations.

The 2021 evaluation was facilitated by Carol Bolger CDir. who has no connection to the Group. The process involved completion of in-depth questionnaires and engagement. The focus areas included ensuring effective oversight in a virtual environment, Board composition, quality of information, time allocation and decision making processes. The responses were collated and the external facilitator presented a report of the questionnaire findings to the Chairman together with observations thereon. The Chairman used this report to lead a discussion with the Board on overall effectiveness. Within this process, the non-executive Directors, led by the Senior Independent Director, evaluated the Chairman’s performance. The performance of individual directors was also assessed by the Chairman following discussions, held by the Chairman, with directors on an individual basis.

Following the conclusion of the process, the Chairman reported to the Board on the outcome of the evaluation process which indicated that the Board as a whole was operating effectively for the long-term success of the Group and that each Director was contributing effectively and demonstrating commitment to the role. While no areas of concern were highlighted, a number of Board process matters are to be followed up with a view to improving overall reporting to the Board. Separately, the Senior Independent Director reported that the Chairman was providing effective leadership of the Board.

Audit Risk and Internal Control

The Board has described its business model on page 18 setting out how the Company generates value over the longer term and the strategy for delivering the objectives of the Company.

The Board has overall responsibility for determining the Group’s risk appetite but has delegated responsibility for the review, design implementation and monitoring of the Group’s internal control system to the Audit Committee. These systems are designed to manage rather than eliminate the risk of failure to achieve business objectives, and can only provide reasonable, and not absolute, assurance against material misstatement or loss.

In accordance with Guidance on Risk Management, Internal Control and Related Financial and Business Reporting (September 2014) issued by the FRC, the Board confirms that there is a continuous process for identifying, evaluating and managing the significant risks faced by the Group, that it has been in place for the period under review and up to the date of approval of the Financial Statements, and that this process is regularly monitored by the Board. The report of the Audit Committee is set out on pages 94 to 99. The risk management framework and processes including the principal risks and uncertainties identified are set out on pages 62 to 71.

No material weaknesses in internal controls were reported to the Board during the year.

Taking account of the Group’s current position and principal risks, the Directors have set out their assessment of the prospects for the Group in the Viability Statement on pages 116 to 117.

Reporting

The Board is committed to providing a fair, balanced and understandable assessment of the Group’s position and prospects to shareholders through the Annual Report, the Interim Statement and any other public statement issued by the Group. The Directors have considered the Annual Report based on a review performed by the Audit Committee and have concluded that it represents a fair, balanced and understandable assessment of the Group’s position and prospects.

Remuneration

The Board has delegated the approval of remuneration structures and levels of the executive Directors and senior management to the Remuneration Committee whose report is set out at pages 102 to 114.

Diversity

The Board has adopted a Board Diversity Policy in compliance with the European Union (Disclosure of non-financial and diversity information by certain large undertakings and Groups) Regulation 2017. The promotion of a diverse Board makes prudent business sense, promotes effective decision-making and ensures stronger corporate governance.

The Group seeks to maintain a Board comprised of talented and dedicated Directors with a diverse mix of expertise, experience, skills and backgrounds reflecting the diverse nature of the business environment in which the Group operates. For purposes of Board composition, diversity includes, but is not limited to, age, gender or educational and professional backgrounds.

When assessing Board composition or identifying suitable candidates for appointment or re-election to the Board, the Group, through the Nomination Committee, considers candidates on merit against objective criteria having due regard to the benefits of diversity and the needs of the Board.

The Nomination Committee will give due regard to diversity when reviewing Board composition and considering Board candidates. The Committee will report annually, in the corporate governance section of the Annual Report, on the process it has used in relation to any Board appointments.

Beyond the Board, of 62 individuals holding a managerial position, 21% are female. While the Board acknowledges the imbalance of this ratio compared to society at large, it is reflective in part of the sector in which the Group operates. Against this background, the Board has not set any gender ratio target but is committed to improving this ratio over time. In that regard the Nomination Committee and Executive Management Team, as appropriate, will actively seek out a greater pool of female candidates when undertaking any future recruitment process.

Matters Pertaining to Share Capital

The information set out below is required to be contained in the Report of the Directors under Regulation 21 of the European Communities (Takeover Bids (Directive 2004/25/EC)) Regulations 2006 (S.I. 255/2006). The information represents the position at 31 December 2020.

For the purposes of Regulations 21(2)(c), (e), (j) and (k) of the European Communities (Takeover Bids (Directive 2004/25/EC)) Regulations 2006 (S.I. 255/2006), the information given under the following headings: (i) Substantial Shareholdings page 118; (ii) Share Option Plans page 112; (iii) Long Term Incentive Plan pages 108 to 109; (iv) Service Contracts page 112; and (v) Share-based Payments pages 179 to 181; (vi) Borrowings pages 167 to 169; are deemed to be incorporated into this statement.

Share Capital

The authorised share capital of the Company is €29,295,000 divided into 450,000,000 ordinary shares of €0.065 each (ordinary shares) and 4,500,000,000 redeemable shares of €0.00001 each (redeemable shares). The ordinary shares represent approximately 99.85% and the redeemable shares represent approximately 0.15% of the authorised share capital. The issued share capital of the Company as at the date of this report is 182,794,567 ordinary shares. There are no redeemable shares currently in issue.

Ordinary shares and redeemable shares (to the extent redeemable shares are in issue) are inextricably linked as an ICG Unit. An ICG Unit is defined in the Constitution of the Company as one Ordinary Share in the Company and ten Redeemable Shares (or such lesser number thereof, if any, resulting from the redemption of one or more thereof) held by the same holder(s).

The rights and obligations attaching to the ordinary shares and redeemable shares are contained in the Constitution of the Company.

The Directors may exercise their power to redeem redeemable shares from time to time pursuant to the Company’s Constitution where there are redeemable shares in issue.

The structure of the Group’s and Company’s capital and movements during the year are set out in notes 20 and 21 to the Financial Statements.

Restrictions on the Transfer of Shares

There is no requirement to obtain the approval of the Company, or of other holders of ICG Units, for a transfer of ICG Units. Certain restrictions may from time to time be imposed by laws or regulations such as those relating to insider dealing.

For so long and to the extent that any redeemable shares are in issue, transfers of ordinary shares and redeemable shares can, in those circumstances, only be effected where the transfer of one class of share (e.g. ordinary share) involves a simultaneous transfer of the other linked class of shares (e,g, redeemable share) as an ICG Unit. As noted, there are currently no redeemable shares in issue. An ICG Unit comprised one ordinary share and nil redeemable shares at 31 December 2021 and 31 December 2020.

ICG Units are, in general, freely transferable but, in accordance with the Companies Act 2014 (as amended) and the Constitution, the Directors may decline to register a transfer of ICG Units upon notice to the transferee, within two months after the lodgement of a transfer with the Company, in the following cases:

- if redeemable shares are in issue, where the transfer of shares does not involve a simultaneous transfer of the other class of shares with which such shares are linked as an ICG Unit (as described immediately above);

- a lien is held by the Company; or

- in the case of a purported transfer to or by a minor or a person lawfully adjudged not to possess an adequate decision-making capacity;

- unless the instrument of transfer is accompanied by the certificate of the shares to which it relates (if any) and such other evidence as the Directors may reasonably require to show the right of the transferor to make the transfer; or

- unless the instrument of transfer is in respect of one class only (unless redeemable shares are in issue and the proposed transfer is in respect of ICG Units).

ICG Units held in certificated form are transferable upon production to the Company’s Registrars of the original share certificate and the usual form of stock transfer or instrument duly executed by the holder of the shares.

ICG Units held in uncertificated form are transferable in accordance with the rules or conditions imposed by the operator of the relevant system which enables title to the ICG Units to be evidenced and transferred without a written instrument and in accordance with the Companies Act, 1990 (Uncertificated Securities) Regulations 1996 (S.I. 68/1996) and Section 1085 of the Companies Act 2014 (as amended).

The rights attaching to ordinary shares and redeemable shares comprised in each ICG Unit remain with the transferor until the name of the transferee has been entered on the Register of Members of the Company.

No person holds securities in the Company carrying special rights with regard to control of the Company. The Company is not aware of any agreements between holders of securities that may result in restrictions in the transfer of securities or voting rights.

The Powers of the Directors Including in Relation to the Issuing or Buying Back by the Company of its Shares

Under the Constitution of the Company, the business of the Company is to be managed by the Directors who may exercise all the powers of the Company subject to the provisions of the Companies Acts 2014 (as amended), the Constitution of the Company and to any directions given by members at a General Meeting. The Constitution further provides that the Directors may make such arrangements as may be thought fit for the management of the Company’s affairs including the appointment of such attorneys or agents as they consider appropriate and delegate to such persons such powers as the Directors may deem requisite or expedient.

At the Company’s AGM held on 12 May 2021, resolutions were passed whereby

- the Company, or any of its subsidiaries, were authorised to make market purchases of up to 15% of the issued share capital of the Company.

- the Directors were authorised until the conclusion of the next AGM, to allot shares up to an aggregate nominal value of 66.66% of the then present issued ordinary share capital and the present authorised but unissued redeemable share capital of the Company subject to the provision that any shares allotted in excess of 33.33% of the then present issued ordinary share capital must be allotted pursuant to a rights issue.

In line with market practice, members will be asked to renew these authorities at the 2022 AGM.

General Meetings and Shareholders Voting and other Rights

Under the Constitution, the power to manage the business of the Company is generally delegated to the Directors. However, the members retain the power to pass resolutions at a General Meeting of the Company which may give directions to the Directors as to the management of the Company.

The Company must hold an AGM each year in addition to any other meetings in that year and no more than 15 months may elapse between the date of one AGM and that of the next. The AGM will be held at such time and place as the Directors determine. All General Meetings, other than AGMs, are called Extraordinary General Meetings.

Extraordinary General Meetings shall be convened by the Directors or on the requisition of members holding, at the date of the requisition, not less than five percent of the paid up capital carrying the right to vote at General Meetings and in default of the Directors acting within 21 days to convene such a meeting to be held within two months, the requisitionists (or more than half of them) may, but only within three months, themselves convene a meeting.

No business may be transacted at any General Meeting unless a quorum is present at the time when the meeting proceeds to business. Two or more members present in person or by proxy and entitled to vote at such meeting constitutes a quorum.

The holders of ICG Units have the right to receive notice of, attend, speak and vote at all General Meetings of the Company.

In the case of an AGM or of a meeting for the passing of a Special Resolution or the appointment of a Director, 21 clear days’ notice at the least, and in any other case 14 clear days’ notice at the least (assuming that the members have passed a resolution to this effect at the previous year’s AGM), needs to be given in writing in the manner provided for in the Constitution to all the members, Directors, Secretary, the Auditor for the time being of the Company and to any other person entitled to receive notice under the Companies Act.

Voting at any General Meeting is by a show of hands unless a poll is properly demanded. On a show of hands, every member who is present in person or by proxy has one vote regardless of the number of shares held by a shareholder. On a poll, every member who is present in person or by proxy has one vote for each share of which he/she is the holder. A poll may be demanded by the Chairman of the meeting or by at least three members having the right to vote at the meeting or by a member or members representing not less than one-tenth of the total voting rights of all the members having the right to vote at the meeting or by a member or members holding shares in the Company conferring a right to vote at the meeting, being shares on which an aggregate sum has been paid up equal to not less than one-tenth of the total sum paid up on all the shares conferring that right.

Deadlines for Exercising Voting Rights

Voting rights at General Meetings of the Company are exercised when the Chairman puts the resolution at issue to the vote of the meeting. A vote decided on a show of hands is taken forthwith. A vote taken on a poll for the election of the Chairman or on a question of adjournment is also taken forthwith and a poll on any other question is taken either immediately, or at such time (not being more than 30 days from the date of the meeting at which the poll was demanded or directed) as the Chairman of the meeting directs. Where a person is appointed to vote for a member as proxy, the instrument of appointment must be received by the Company not less than 48 hours before the time appointed for holding the meeting or adjourned meeting at which the appointed proxy proposes to vote, or, in the case of a poll, not less than 48 hours before the time appointed for taking the poll.

EU (Shareholders' Rights) Regulations 2020

The holders of ICG Units have the right to attend, speak, ask questions and vote at General Meetings of the Company. The Company, pursuant to Section 1105 of the Companies Act 2014 and Regulation 14 of the Companies Act 1990 (Uncertificated Securities) Regulations 1996, specifies record dates for General Meetings, by which date members must be registered in the Register of Members of the Company to be entitled to attend and vote at the meeting.

Pursuant to Section 1104 of the Companies Act 2014, a member, or a group of members who together hold at least three per cent of the issued share capital of the Company, representing at least three per cent of the total voting rights of all the members who have a right to vote at the meeting to which the request for inclusion of the item relates, have the right to put an item on the agenda, or to modify an agenda which has been already communicated, of a General Meeting. In order to exercise this right, written details of the item to be included in the General Meeting agenda must be accompanied by stated grounds justifying its inclusion or a draft resolution to be adopted at the General Meeting together with evidence of the member or group of members shareholding must be received, by the Company, 42 days in advance of the meeting to which it relates.

The Company publishes the date of its AGM on its website www.icg.ie on or before 31 December of the previous financial year.

Rights to Dividends and Return of Capital

Subject to the provisions of the Company’s Constitution, the holders of the ordinary shares in the capital of the Company shall be entitled to such dividends as may be declared from time to time on such shares. The holders of the redeemable shares (if any) shall not be entitled to any dividends.

On a return of capital on a winding up of the Company or otherwise (other than on a conversion, redemption or purchase of shares), the holders of the ordinary shares shall be entitled, pari passu with the holders of the redeemable shares (if any) to the repayment of a sum equal to the nominal capital paid up or credited as paid up on the shares held by them respectively. Thereafter, the holders of the ordinary shares shall be entitled to the balance of the surplus of assets of the Company to be distributed rateably according to the number of ordinary shares held by a member. The redeemable shares shall not confer upon the holders thereof any rights to participate further in the profits or assets of the Company.

Rules Concerning Amendment of the Company’s Constitution

As provided in the Companies Act 2014, the Company may, by special resolution, alter or add to its Constitution. A resolution is a special resolution when it has been passed by not less than 75 per cent of the votes cast by members entitled to vote and voting in person or by proxy, at a General Meeting at which not less than 21 days’ notice specifying the intention to propose the resolution as a special resolution, has been duly given.

Rules Concerning the Appointment and Replacement of Directors of the Company

Other than in the case of a casual vacancy, Directors of the Company are appointed on a resolution of the members at a General Meeting, usually the AGM.

No person, other than a Director retiring at a General Meeting is eligible for appointment as a Director without a recommendation by the Directors for that person’s appointment unless, not less than six or more than 40 clear days before the date of the General Meeting, written notice by a member, duly qualified to be present and vote at the meeting, of the intention to propose the person for appointment and notice in writing signed by the person to be proposed of willingness to act, if so appointed, shall have been given to the Company.

The Directors have power to fill a casual vacancy or to appoint an additional Director (within the maximum number of Directors fixed by the Constitution of the Company (as may be amended by the Company in a General Meeting)) and any Director so appointed holds office only until the conclusion of the next AGM following their appointment, when the Director concerned shall retire, but shall be eligible for reappointment at that meeting.

Each Director must retire from office no later than the third AGM following their last appointment or reappointment. In addition, one-third of the Directors for the time being (or if their number is not three or a multiple of three, then the number nearest to one-third), are obliged to retire from office at each AGM on the basis of the Directors who have been longest in office since their last appointment.

The Company has adopted the provisions of the UK Corporate Governance Code in respect of the annual election of all Directors. All Directors will retire at the forthcoming AGM and following review are being recommended for re-election.

A person is disqualified from being a Director, and their office as Director ipso facto vacated, in any of the following circumstances:

- if s/he is adjudicated bankrupt or being bankrupt has not obtained a certificate of discharge in the relevant jurisdiction; or

- if in the opinion of a majority of his/her co-Directors, the health of the Director is such that he or she can no longer be reasonably regarded as possessing an adequate decision-making capacity so that s/he may discharge his/her duties; or

- if s/he ceases to be, or is removed as a Director by virtue of any provision of the Acts or the Articles, or s/he becomes prohibited by law from being a Director or is restricted by law in acting as a Director; or

- if s/he (not being a Director holding for a fixed term an executive office in his/her capacity as a Director) resigns his/her office by notice in writing to the Company; or

- if s/he is absent for six successive months without permission of the Directors from meetings of the Directors held during that period and the Directors pass a resolution that by reason of such absence s/he has vacated office; or

- if s/he is removed from office by notice in writing served upon him/her signed by all his/her co-Directors; if s/he holds an appointment to an executive office which thereby automatically determines, such removal shall be deemed an act of the Company and shall have effect without prejudice to any claim for damages for breach of any contract of service between him/her and the Company; or

- if s/he is convicted of an indictable offence not being an offence under the Road Traffic Act, 1961 or any statutory provision in lieu or modification thereof.

Notwithstanding anything in the Constitution or in any agreement between the Company and a Director, the Company may, by Ordinary Resolution of which the required notice has been given in accordance with Section 146 of the Companies Act 2014, remove any Director before the expiry of their period of office.

Replacement of CREST with Euroclear Bank for Electronic Settlement of Trading in the Company’s shares

On 15 March 2021 electronic settlement of trades in the Company’s shares migrated from the UK CREST System to Euroclear Bank SA/NV, an international central securities depository based in Belgium and part of the Euroclear Group. This migration was necessary as a result of the exit of the United Kingdom from the EU and the legislative requirement that electronic settlement occur through an authorised central securities depository that is established in a member state of the EU or under an approved third country arrangement. The required shareholder authorisations for the migration were given at an EGM held on 12 February 2021.