Report on the audit of the Financial Statements

Opinion on the Financial Statements of Irish Continental Group plc (the “Company”) and its subsidiaries (the ‘Group’)

In our opinion, the Group and Company Financial Statements:

- give a true and fair view of the assets, liabilities and financial position of the Group and Company as at 31 December 2020 and of the loss of the Group for the financial year then ended; and

- have been properly prepared in accordance with the relevant financial reporting frameworks and, in particular, with the requirements of the Companies Act 2014 and, as regards the Group financial statements, Article 4 of the IAS Regulation.

The Financial Statements we have audited comprise the:

- the Group Financial Statements:

- the Consolidated Income Statement;

- the Consolidated Statement of Comprehensive Income;

- the Consolidated Statement of Financial Position;

- the Consolidated Statement of Changes in Equity;

- the Consolidated Statement of Cash Flows; and

- the related notes 1 to 37, including a summary of significant accounting policies as set out in note 2 to the Financial Statements.

- the Company financial statements:

The relevant financial reporting framework that has been applied in the preparation of the Group Financial Statements is the Companies Act 2014 and International Financial Reporting Standards (IFRS) as adopted by the European Union (“the relevant financial reporting framework”).

The relevant financial reporting framework that has been applied in the preparation of the Company Financial Statements is the Companies Act 2014 and FRS 101 “Reduced Disclosure Framework” issued by the Financial Reporting Council (“the relevant financial reporting framework”).

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (Ireland) (ISAs (Ireland)) and applicable law. Our responsibilities under those standards are described below in the “Auditor’s responsibilities for the audit of the Financial Statements” section of our report.

We are independent of the Group and Company in accordance with the ethical requirements that are relevant to our audit of the Financial Statements in Ireland, including the Ethical Standard issued by the Irish Auditing and Accounting Supervisory Authority (IAASA), as applied to public interest entities, and we have fulfilled our other ethical responsibilities in accordance with these requirements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Summary of our audit approach | |

Key audit matters | The key audit matters that we identified in the current year were:

|

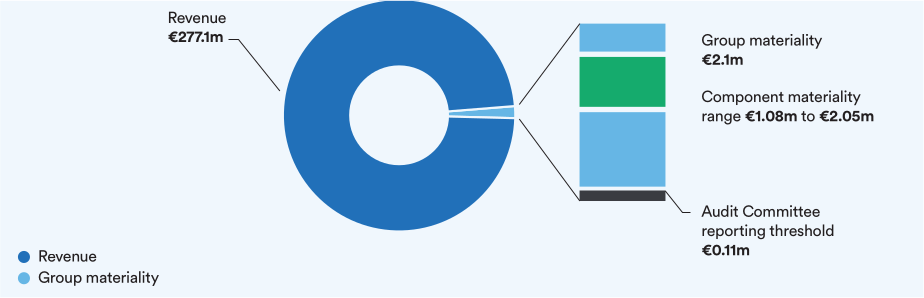

Materiality | The materiality that we used in the current year for the Group was €2.1m which was determined on the basis of revenue for the 12 months ended 31 December 2020, representing approximately 0.8% of the benchmark. The materiality that we used in the current year for the Company was €1.57m which was determined on the basis of net assets as at 31 December 2020, representing 0.9% of the benchmark. |

Scoping | We determined the scope of our Group audit by obtaining an understanding of the Group and its environment, including Group-wide controls, and assessing the risks of material misstatement at the Group level. Based on that assessment, we focused our audit scope primarily on the audit work in fifteen components. Four of these were subject to a full scope audit, a further seven components were subject to audits of specified account balances and the remaining four entities were subject to analytical procedures. |

Significant changes in our approach | Significant changes in our audit approach in the current year were as follows: Key Audit Matters: In the prior year, the key audit matter related to the carrying value of vessels was focused on the appropriateness of the useful lives and residual values of vessels used in the determination of the depreciation charge. This was due to a material addition to vessels which took place in the 2019 financial year; whereas in the current year the key audit matter is focused on the assessment of impairment indicators due to the impact of Covid-19 on the financial performance of the Group. Going concern is a new key audit matter in the current year. Going concern was identified as a key audit matter after considering the current economic and trading environment of the Group and Company as a consequence of continued restriction on non-essential travel resulting from the Covid-19 pandemic. Materiality: Given the current operating environment, where we have seen volatility in the previous benchmark used in the prior year, being profit before taxation and non-trading items, we have considered revenue an appropriate base for determining the materiality for the Group as there is a greater emphasis on revenue in the current year as an indicator of demand going forward. |

Conclusions relating to going concern

In auditing the Financial Statements, we have concluded that the Directors’ use of the going concern basis of accounting in the preparation of the Financial Statements is appropriate.

Our evaluation of the Directors’ assessment of the Group and Company’s ability to continue to adopt the going concern basis of accounting is discussed in the Key Audit Matters section of our report.

Based on the work we have performed, we have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on the Group and Company’s ability to continue as a going concern for a period of at least twelve months from when the Financial Statements are authorised for issue.

In relation to the reporting on how the Group has applied the UK Corporate Governance Code and the Irish Corporate Governance Annex, we have nothing material to add or draw attention to in relation to the Directors’ statement in the financial statements about whether the Directors considered it appropriate to adopt the going concern basis of accounting.

Our responsibilities and the responsibilities of the Directors with respect to going concern are described in the relevant sections of this report.

Key Audit Matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the Financial Statements of the current financial year and include the most significant assessed risks of material misstatement (whether or not due to fraud) we identified, including those which had the greatest effect on: the overall audit strategy, the allocation of resources in the audit, and directing the efforts of the engagement team. These matters were addressed in the context of our audit of the Financial Statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

In the prior year, the key audit matter related to the carrying value of vessels was focused on the appropriateness of the useful lives and residual values of vessels used in the determination of the depreciation charge. This was due to a material addition to vessels which took place in the 2019 financial year; whereas in the current year the key audit matter is focused on the assessment of impairment indicators due to the impact of Covid-19 on the financial performance of the Group.

Going concern is a new key audit matter in the current year. Going concern was identified as a key audit matter after considering the current economic and trading environment of the Group and Company as a consequence of continued restriction on non-essential travel resulting from the Covid-19 pandemic.

Going concern | |

Key audit matter description | As stated in note 3 to the Financial Statements, the performance of the Group has been significantly affected by the imposition of restrictions on non-essential travel across the jurisdictions in which the Group offers services since March 2020 as a result of the Covid-19 pandemic. We identified Going Concern as a key audit matter due to the judgements involved in capturing uncertainties around the timing of the lifting of restrictions on non-essential travel and the return of previous travel patterns. Please also refer to page 84 (Audit Committee Report) and note 3 – Critical accounting judgements and key sources of estimation uncertainty. |

How the scope of our audit responded to the key audit matter | We obtained an understanding of the Group and Company’s controls for the development and approval of the projections and assumptions used in the cash flow forecast model to support the going concern assessment and assessed the design and determined the implementation of the relevant controls. We evaluated the Group and Company’s financing arrangements, including the agreements in respect of the undrawn committed bank facilities in place within the Group. We checked the clerical accuracy of the cash flow forecast model, completed an assessment of the consistency of the model used to prepare the forecasts in line with other areas of our audit and performed a look back analysis of the historical accuracy of cash flow forecast models prepared by the Directors. We evaluated and assessed the appropriateness of the sensitivity analysis prepared by the Directors and challenged the assumptions and basis for their evaluation and inclusion of sensitivities incorporated into the cash flow forecast model. We also evaluated and challenged the Directors’ assessment of the impact of Covid-19. We assessed the results of the Group for the period after the reporting date compared to budget in order to assess if there are any early indicators that management have been too optimistic in their forecasting for the current year or whether there are any other indicators that the business may not be able to continue as a going concern. We considered throughout the audit any contradictory information to the Directors’ confirmation that the Group and Company are a going concern, including evaluating whether the assumptions in the cash flow forecast model is realistic, achievable and consistent with the external and internal environment. We evaluated the completeness and accuracy of the disclosures made in the Basis of preparation note on page 128 and Critical accounting judgements and key sources of estimation uncertainty note on page 141 by reference to the understanding we had obtained of the Group and Company’s financial performance during 2020 and our assessment of the directors’ projections, including the impact of Covid-19 and the adequacy of disclosures in relation to the specific risks posed by the pandemic. |

Key observations | We have concluded that the adoption of the going concern basis of accounting and the related disclosures are appropriate. Please refer to our conclusions in the going concern section of our report. |

Assessment of potential indicators of impairment to the carrying value of vessels | |

Key audit matter description | As stated in note 13 to the Financial Statements, the carrying value of vessels held by the Group is €277.7m as at 31 December 2020. The Group’s evaluation of vessels for indicators of impairment is performed annually or when events or changes in circumstances indicate that the carrying values may not be recoverable. Factors considered in identifying whether there are any indications of impairment include the economic performance of assets, technological developments, new rules and regulations, shipbuilding costs and carrying value versus the market capitalisation of the Group. During the period, the Group experienced a decline in activity levels mainly concentrated on passenger carryings due to the imposition of restrictions on non-essential travel in the jurisdictions in which the Group offers services since March 2020 as a result of the Covid-19 pandemic. We have identified the assessment of potential indicators of impairment to the carrying value of vessels as a key audit matter due to the decline in Group activity levels noted in the current year. Please also refer to page 84 (Audit Committee Report), page 135 (Accounting Policy – Property, Plant and Equipment), and note 3 – Critical accounting judgements and key sources of estimation uncertainty and note 13 Property, Plant and Equipment. |

How the scope of our audit responded to the key audit matter | We obtained an understanding of management’s controls for the assessment of potential indicators of impairment, which included reviews by senior members of management and the Board, and assessed the design and determined the implementation of the relevant controls. We evaluated and challenged management’s judgements around the projected recovery from Covid-19, the easing of the related restrictions on non-essential travel, and the potential impact of these on the projected financial performance of the Group. We evaluated and challenged the appropriateness of management’s assessment of potential indicators of impairment. This included reviewing and challenging management’s projections of the future financial performance of the vessels with the assistance of our valuation specialists, by:

We evaluated and assessed the adequacy of the disclosures made in the Financial Statements, including the disclosure of the critical accounting judgements in management’s assessment of potential indicators of impairment to the carrying value of the vessels. |

Key observations | Based on the work performed, we determined that management’s assessment that there were no indicators of impairment, and consequently no impairment to the carrying value of the vessels was appropriate. |

Appropriateness of key assumptions used to determine retirement benefit liabilities | |

Key audit matter description | The Group operates a number of defined benefit schemes. The net pension liability as at 31 December 2020 amounted to €1.2m consisting of pension assets of €1.0m and deficits of €2.2m. There is a high degree of estimation uncertainty and judgement in the calculation of the pension liabilities, particularly in the determination of appropriate actuarial assumptions in respect of the discount, mortality and inflation rates. We identified the discount rate as the being the most volatile key assumption where a small movement can have a significant impact on the calculation of the pension liabilities. We have identified appropriateness of key assumptions used to determine retirement benefit liabilities as a key audit matter due to the volatility of these assumptions and the significant impact they have on the calculation of the pension liabilities. Please also refer to page 84 (Audit Committee Report), page 133 (Accounting Policy – Retirement Benefit Schemes), and note 3 – Critical accounting judgements and estimates. |

How the scope of our audit responded to the key audit matter | We obtained an understanding of management’s processes, assessed the design and determined the implementation of the relevant controls, which included reviews by senior members of management and the Board to ensure the current assumptions used are appropriate. We utilised Deloitte Actuarial Specialists as part of our team to assist us in understanding, evaluating and challenging the appropriateness of the discount rate and other key assumptions. We made inquiries with both management and the Group’s external pension advisors to understand their processes in determining the discount rate and other key assumptions used in calculating retirement benefit liabilities. We benchmarked the discount rate and other key assumptions used against comparable market and peer data, where available to ensure that they were within appropriate ranges and reasonable given our knowledge of the schemes. We assessed whether the disclosures made in the Financial Statements in respect of retirement benefit schemes were in accordance with the relevant accounting standards. |

Key observations | Based on the evidence obtained, we found that the discount rate and other assumptions used by management in the actuarial valuations for pension liabilities are within a range we consider reasonable. |

Cut-off of revenue recognised in the current year | |

Key audit matter description | When making our assessment of the potential risk of fraud in relation to revenue recognition, we considered the nature of the transactions across the Group. The Group recognises revenue in respect of its various streams over the performance period of the underlying contract obligations. There is a risk that revenues are manipulated through recording of future revenues prematurely; or recording cash received from customers for future performance obligations as revenue to achieve performance targets. We have therefore identified a key audit matter in relation to proper cut-off of revenue recorded at year end. Please also refer to page 130 (Accounting Policy – Revenue Recognition), note 4 segmental information. |

How the scope of our audit responded to the key audit matter | We obtained an understanding of the significant revenue arrangements in place across the Group, and of the internal controls over those revenue streams. We evaluated the design and determined the implementation of relevant internal controls over the Group’s significant revenue processes, including operational controls in place around passenger numbers and freight volumes, to assess whether revenue was recognised where the date of travel or transportation had occurred. We also evaluated the design and determined the implementation of relevant controls over the revenue recognition journals that are recorded at year end. We tested, on a sample basis, revenue recognised around year end for the various revenue streams across the Group to assess if the performance obligations were met in line with the underlying contractual arrangements with customers for the associated revenue recognised to ensure that it was recognised appropriately. We tested on a sample basis, cash received from the customers to assess if the performance obligations were met in line with the underlying contractual arrangements with customers and to ensure that cash received for future performance obligations were recorded as deferred revenue. |

Key observations | We have no observations that impact on our audit in respect of the amounts related to the cut-off of revenue recognised in the current year. |

Our audit procedures relating to these matters were designed in the context of our audit of the Financial Statements as a whole, and not to express an opinion on individual accounts or disclosures. Our opinion on the Financial Statements is not modified with respect to any of the risks described above, and we do not express an opinion on these individual matters.

Our application of materiality

We define materiality as the magnitude of misstatement that makes it probable that the economic decisions of a reasonably knowledgeable person, relying on the Financial Statements, would be changed or influenced. We use materiality both in planning the scope of our audit work and in evaluating the results of our work.

We determined materiality for the Group to be €2.1m, which is approximately 0.8% of revenue. In the previous year, materiality for the Group was determined on the basis of profit before tax and non- trading items. In the current year this was not considered an appropriate benchmark because it was uncertain and could not be reliably estimated during the year due to the impact of Covid-19. In addition, there is a greater emphasis on revenue in the current year as an indicator of demand going forward and is the key focus of the users of the Financial Statements.

We determined materiality for the Company to be €1.57m, which is approximately 0.9% of net assets, as the most significant driver of the Company is the capital and reserve balance. Net assets were also the benchmark used to determine materiality for the Company in the prior year.

We have considered quantitative and qualitative factors, such as understanding the entity and its environment, history of misstatements, complexity of the Group and reliability of the control environment.

We agreed with the Audit Committee that we would report to them any audit differences in excess of €105,000, as well as differences below that threshold which, in our view, warranted reporting on qualitative grounds. We also report to the Audit Committee on disclosure matters that we identified when assessing the overall presentation of the Financial Statements.

An overview of the scope of our audit

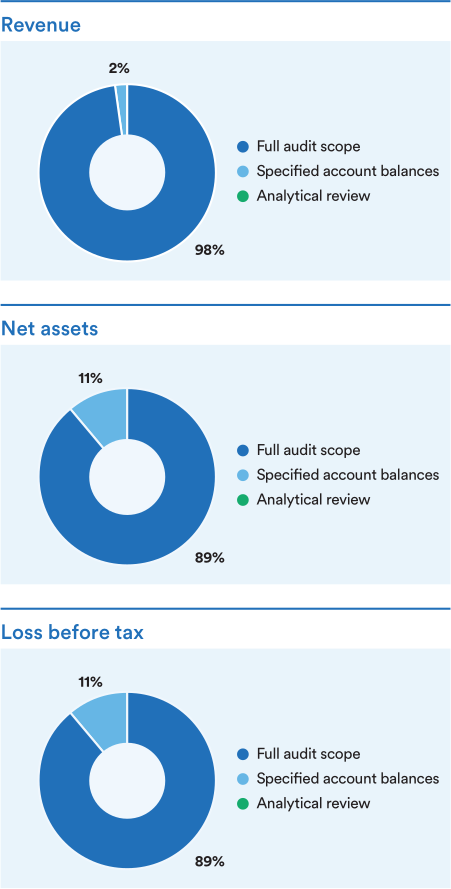

We determined the scope of our Group audit by obtaining an understanding of the Group and its environment, including Group-wide controls, and assessing the risks of material misstatement at the Group level. Based on that assessment, we focused our Group audit scope primarily on the audit work in fifteen components. Four of these were subject to a full scope audit and seven components were subject to audits of specified account balances, where the extent of our testing was based on our assessment of the risks of material misstatement and of the materiality of the Group’s operations in those components. The remaining four entities were subject to analytical procedures at the Group level.

These components were selected based on coverage achieved, the qualitative and risk considerations of these components and to provide an appropriate basis for undertaking audit work to address the risks of material misstatement identified. Our audit work at the fifteen components was executed at levels of materiality applicable to each individual unit which were lower than Group materiality and ranged from €1.08m to €2.05m.

At the Group level, we also tested the consolidation process and carried out analytical procedures to confirm our conclusion that there were no significant risks of material misstatement of the aggregated financial information of the remaining components not subject to audit or audit of specified account balances.

The Group audit team virtually attended planning meetings for all components. In addition to our planning meetings, we sent detailed instructions to our component audit teams, included them in our virtual team briefings, discussed their risk assessment, attended virtual client planning and closing meetings, and reviewed their audit working papers remotely.

We have considered the impact of Covid-19 on the Group’s business as part of our audit risk assessment and planning. This assessment resulted in increased focus on the Group’s key judgement and estimates in relation to future strategic plans and profitability forecasts which are key inputs into the Group’s assessment of the potential indicators of impairment to the carrying value of vessels and going concern assessment.

The levels of coverage of key financial aspects of the Group by type of audit procedures are as set out below:

Other information

The other information comprises the information included in the Annual Report, other than the Financial Statements and our auditor’s report thereon. The Directors are responsible for the other information contained within the Annual Report.

Our opinion on the Financial Statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

Our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the Financial Statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the Financial Statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in this regard.

Responsibilities of Directors

As explained more fully in the Directors’ Responsibilities Statement, the Directors are responsible for the preparation of the Financial Statements and for being satisfied that they give a true and fair view and otherwise comply with the Companies Act 2014, and for such internal control as the Directors determine is necessary to enable the preparation of Financial Statements that are free from material misstatement, whether due to fraud or error.

In preparing the Financial Statements, the Directors are responsible for assessing the Group and Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the Directors either intend to liquidate the Group and Company or to cease operations, or have no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the Financial Statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (Ireland) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these Financial Statements.

As part of an audit in accordance with ISAs (Ireland), we exercise professional judgment and maintain professional scepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the Financial Statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group and Company’s internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the Directors.

- Conclude on the appropriateness of the Directors’ use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group and Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the Financial Statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of the auditor’s report. However, future events or conditions may cause the entity (or where relevant, the Group) to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the Financial Statements, including the disclosures, and whether the Financial Statements represent the underlying transactions and events in a manner that achieves fair presentation.

- Obtain sufficient appropriate audit evidence regarding the financial information of the business activities within the Group to express an opinion on the (Consolidated) Financial Statements. The Group auditor is responsible for the direction, supervision and performance of the Group audit. The Group auditor remains solely responsible for the audit opinion.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that the auditor identifies during the audit.

For listed entities and public interest entities, the auditor also provides those charged with governance with a statement that the auditor has complied with relevant ethical requirements regarding independence, including the Ethical Standard for Auditors (Ireland) 2016, and communicates with them all relationships and other matters that may reasonably be thought to bear on the auditor’s independence, and where applicable, related safeguards.

Where the auditor is required to report on key audit matters, from the matters communicated with those charged with governance, the auditor determines those matters that were of most significance in the audit of the Financial Statements of the current period and are therefore the key audit matters. The auditor describes these matters in the auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, the auditor determines that a matter should not be communicated in the auditor’s report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

Report on other legal and regulatory requirements

Opinion on other matters prescribed by the Companies Act 2014

Based solely on the work undertaken in the course of the audit, we report that:

- We have obtained all the information and explanations which we consider necessary for the purposes of our audit;

- In our opinion the accounting records of the Company were sufficient to permit the Financial Statements to be readily and properly audited;

- The Company statement of financial position is in agreement with the accounting records;

- In our opinion the information given in the Directors’ report is consistent with the Financial Statements and the Directors’ report has been prepared in accordance with the Companies Act 2014.

Corporate Governance Statement required by the Companies Act 2014

We report, in relation to information given in the Corporate Governance Statement on pages 71 to 83 that:

- In our opinion, based on the work undertaken during the course of the audit, the information given in the Corporate Governance Statement pursuant to subsections 2(c) and (d) of section 1373 of the Companies Act 2014 is consistent with the Company’s statutory Financial Statements in respect of the financial year concerned and such information has been prepared in accordance with the Companies Act 2014. Based on our knowledge and understanding of the Company and its environment obtained in the course of the audit, we have not identified any material misstatements in this information.

- In our opinion, based on the work undertaken during the course of the audit, the Corporate Governance Statement contains the information required by Regulation 6(2) of the European Union (Disclosure of Non-Financial and Diversity Information by certain large undertakings and groups) Regulations 2017 (as amended); and

- In our opinion, based on the work undertaken during the course of the audit, the information required pursuant to section 1373(2)(a),(b),(e) and (f) of the Companies Act 2014 is contained in the Corporate Governance Statement.

Corporate Governance Statement

The Listing Rules and ISAs (Ireland) require us to review the directors’ statement in relation to going concern, longer-term viability and the part of the Corporate Governance Statement relating to the Group’s compliance with the provisions of the UK Corporate Governance Code and Irish Corporate Governance Annex specified for our review.

Based on the work undertaken as part of our audit, we have concluded that each of the following elements of the Corporate Governance Statement is materially consistent with the Financial Statements and our knowledge obtained during the audit:

- the Directors’ statement with regards the appropriateness of adopting the going concern basis of accounting and any material uncertainties identified set out on pages 103 to 104;

- the Directors’ explanation as to its assessment of the Group’s prospects, the period this assessment covers and why the period is appropriate set out on page 104;

- the Directors’ statement on fair, balanced and understandable set out on page 106;

- the Board’s confirmation that it has carried out a robust assessment of the emerging and principal risks and the disclosures in the Annual Report that describe the principal risks and the procedures in place to identify emerging risks and an explanation of how they are being managed or mitigated set out on pages 57 to 61;

- the section of the Annual Report that describes the review of effectiveness of risk management and internal control systems set out on pages 55 to 56; and

- the section describing the work of the Audit Committee set out on pages 84 to 87.

Matters on which we are required to report by exception

Based on the knowledge and understanding of the Group and Company and its environment obtained in the course of the audit, we have not identified material misstatements in the Directors’ report.

The Companies Act 2014 also requires us to report to you if, in our opinion, the Company has not provided the information required by Regulation 5(2) to 5(7) of the European Union (Disclosure of Non-Financial and Diversity Information by certain large undertakings and groups) Regulations 2017 (as amended) for the financial year ended 31 December 2020. We have nothing to report in this regard.

The Companies Act 2014 also requires us to report to you if, in our opinion, the Company has not provided the information required by Section 1110N in relation to its remuneration report. We have nothing to report in this regard.

We have nothing to report in respect of the provisions in the Companies Act 2014 which require us to report to you if, in our opinion, the disclosures of Directors’ remuneration and transactions specified by law are not made.

The Listing Rules of the Euronext Dublin require us to review six specified elements of disclosures in the report to shareholders by the Board of Directors’ Remuneration Committee. We have nothing to report in this regard.

Other matters which we are required to address

We were first appointed by Irish Continental Group plc to audit the Financial Statements for the financial year ended 31 October 1988 and subsequent financial periods. The period of total uninterrupted engagement including previous renewals and reappointments of the firm is 32 years, covering the years ending 31 October 1988 and 31 December 2020.

The non-audit services prohibited by IAASA’s Ethical Standard were not provided and we remained independent of the Company in conducting the audit.

Our audit opinion is consistent with the additional report to the audit committee we are required to provide in accordance with ISA (Ireland) 260.

Use of our report

This report is made solely to the Company’s members, as a body, in accordance with Section 391 of the Companies Act 2014. Our audit work has been undertaken so that we might state to the Company’s members those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company’s members as a body, for our audit work, for this report, or for the opinions we have formed.

Ciarán O’Brien

For and on behalf of Deloitte Ireland LLP

Chartered Accountants and Statutory Audit Firm

Deloitte & Touche House, Earlsfort Terrace, Dublin 2

11 March 2021

Notes: An audit does not provide assurance on the maintenance and integrity of the website, including controls used to achieve this, and in particular on whether any changes may have occurred to the Financial Statements since first published. These matters are the responsibility of the Directors but no control procedures can provide absolute assurance in this area.

Legislation in Ireland governing the preparation and dissemination of financial statements differs from legislation in other jurisdictions.