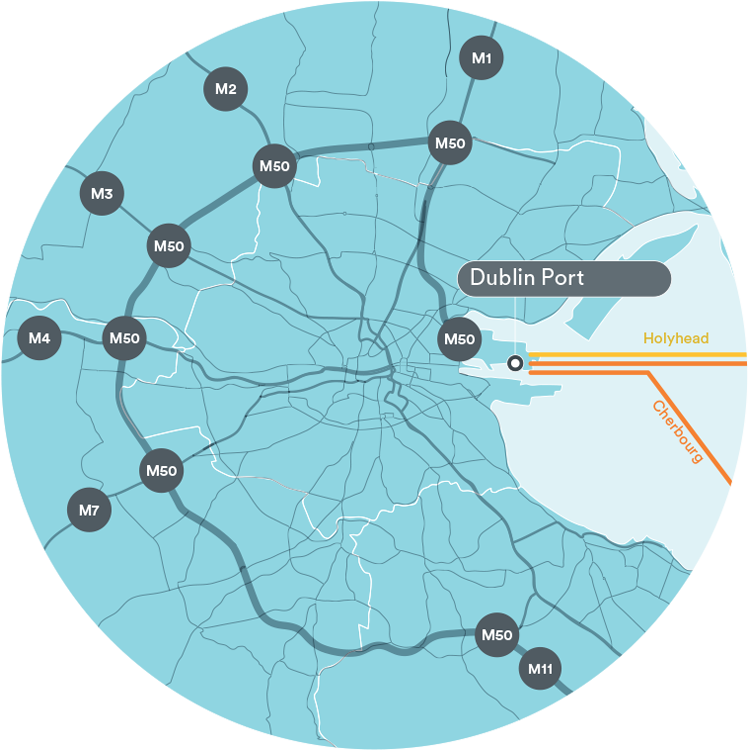

The Ferries Division operates multipurpose ferry services carrying both passengers and RoRo freight on strategic short sea routes between Ireland and the UK and direct ferry services between Ireland and France. The division also engages in chartering activities.

The ferry services trade under the Irish Ferries brand. Irish Ferries operates on three routes utilising a fleet of five vessels, four of which are owned and one which is chartered-in.

Due to Covid-19 travel restrictions the fastcraft Dublin Swift, which normally operates on the Dublin – Holyhead route, was layed-up for the year and did not operate any services.

In addition to the modern fleet, Irish Ferries retains rights to access appropriate berthing times at key ports allowing Irish Ferries to facilitate its customers’ preferred sailing times.

The division also owns six container vessels which are time chartered.

Fleet Summary

Operated by Ferries Division

Vessel | Type | Employment |

Ulysses | Cruise ferry | Dublin – Holyhead |

Isle of Inishmore | Cruise ferry | Rosslare – Pembroke |

Epsilon (chartered-in) | Ropax vessel* | Dublin – Holyhead / Cherbourg |

Dublin Swift | High speed ferry | Dublin – Holyhead |

W.B. Yeats | Cruise ferry | Dublin – Holyhead / Cherbourg |

Chartered out by Ferries Division

Vessel | Type | Employment |

Ranger | LoLo container vessel | Charter – 3rd Party |

Elbfeeder | LoLo container vessel | Charter – Inter-Group |

Elbtrader | LoLo container vessel | Charter – Inter-Group |

Thetis D | LoLo container vessel | Charter – 3rd Party |

CT Rotterdam | LoLo container vessel | Charter – Inter-Group |

Elbcarrier | LoLo container vessel | Charter – Inter-Group |

*A Ropax ferry is a vessel with RoRo freight and passenger capacity.

Revenue in the division was 33.4% lower than the previous year at €141.4 million (2019: €212.4 million). Revenue in the first half of the year decreased by 33.2% to €61.6 million (2019: €92.3 million), while in the second half revenue decreased 33.5%, to €79.8 million (2019: €120.1 million). EBITDA decreased to €22.3 million (2019: €67.2 million) while EBIT was €(12.3) million compared with €36.4 million in 2019.

Fuel costs were €23.8 million, a decrease of €10.9 million on the prior year. The division achieved a return on capital employed of (4.2)% (2019: 17.6%).

In total Irish Ferries operated 4,501 sailings in 2020 (2019: 4,934), the decrease due to the lay-up of the Dublin Swift.

2020 Overall Ferries Division Performance

2020 2019

Revenue

€141.4m

€212.4m | -33.4%

EBITDA

€22.3m

€67.2m | -66.8%

EBIT

€(12.3)m

€36.4m | -133.8%

Non-trading item

€(11.2)m

€14.9m | -175.2%

ROACE

(4.2)%

17.6% | -21.8pts

Car and Passenger Markets

It is estimated that the overall car market*, to and from the Republic of Ireland, fell by approximately 63.5% in 2020 to 284,000 cars, while the all-island market, i.e. including routes into Northern Ireland, is estimated to have decreased by 51.8%. Irish Ferries’ car carryings during the year were down on the previous year by 65.8% to 137,100 cars (2019: 401,300 cars). The reduction in carryings were primarily due to the Covid-19 travel restrictions in place for most of the year.

The total sea passenger market (i.e. comprising car, coach and foot passengers) to and from the Republic of Ireland decreased by 62.5% on 2019 to a total of 1.1 million passengers, while the all-island market decreased by 56.2%. Irish Ferries’ passenger numbers carried decreased by 66.3% at 519,000 (2019: 1.54 million). In the first half of the year, Irish Ferries passenger volumes fell by 63.9% and in the second half of the year, which is seasonally more significant, the decrease in passenger numbers was 68.1%.

The Ferries Division delivered 98% of scheduled sailings compared with 92% in the previous year across all services. Due to Covid-19 travel restrictions, the fastcraft Dublin Swift was layed-up for the year and did not operate any sailings.

In 2020, Irish Ferries rapidly adapted its planned marketing and promotional campaigns to respond to the evolving Covid-19 pandemic. Focus moved to our ‘Travel Safe’ programme and to providing information about our on-board environment with fresh air circulation, access to outdoor decks, space for social distancing, as well as the introduction of new cleaning regimes and procedures onboard to maximise the safety for all passengers undertaking essential travel.

Our website and social channels continued to be much visited and valued hubs for information on these safety measures, the latest updates on travel restrictions in the Irish, British and French marketplaces, as well as providing reassurance on the continuity of our sailing schedules. Our social following increased across the main platforms including Twitter, Facebook and Instagram. Where needed, Irish Ferries also liaised with relevant authorities for the repatriation requirements of citizens stranded because of the pandemic.

Irish Ferries continued to collaborate throughout the year with state tourism agencies in Ireland (Tourism Ireland and Fáilte Ireland) as well as in our tourism source markets for Wales (Visit Wales) and France (Normandy Tourism and Cotentin Tourism). This was to ensure we had the latest insights for each market and that we are ready to deliver co-operatively funded advertising and publicity initiatives once travel for leisure and tourism is advisable again.

In a year of unprecedented challenges, we continued to work in partnership with the travel trade. In 2020, we were delighted to be recognised once again by travel trade professionals and were voted ‘Best Ferry Company’ for the 10th year in a row at the Irish Travel Industry Awards and were awarded in the UK ‘Best Ferry or Fixed Link Operator’ in the Group Leisure & Travel awards for the second year running. These awards were a welcome recognition of our professionalism in handling the difficult circumstances this year.

Sunflower Lanyard

In February 2020, Irish Ferries became the first Irish travel operator to introduce the hidden disability Sunflower Lanyard scheme across its entire fleet. Available to all passengers with hidden disabilities, and an addition to the full range of services already available to passengers with restricted mobility, the discreet Sunflower Lanyard enables crew who are specially trained, to readily identify those on-board who may require some extra help, time or assistance.

Frontline Crew

Our frontline staff and crew adapted to the new challenges and requirements of the extraordinary Covid-19 circumstances, introduced new procedures and cleaning regimes as well as embracing a continuous testing protocol. These measures ensured they were kept safe while providing the highest standards onboard to ensure continued connectivity for our island and protection for our key freight workers and essential travellers.

(See website with details of our ‘Travel Safe’ programme: https://www.irishferries.com/ie-en/offers/Travel-Safe/)

RoRo Freight

The RoRo freight market* between the Republic of Ireland, and the UK and France, fell slightly in 2020 on the back of Covid-19 restrictions in the early part of the year, but was mostly offset in the second half as the Irish and UK economies opened up again. The market was further strengthened due to stockpiling in advance of the end of the UK’s transition period upon exiting the EU. The total number of trucks and trailers was down 1.2%, to approximately 1.03 million units. On an all-island basis, the market decreased by approximately 1.9% to 1.84 million units.

Irish Ferries’ carryings, at 335,500 freight units (2019: 313,200 freight units), increased by 7.1% in the year with volumes down 2.7% in the first half and up 16.6% in the second half. The performance against the market is principally related to the attraction of the short sea market over other routes.

Irish Ferries has also been proactive in the online environment for freight customers. In recent years high-quality mobile options have been developed, alongside the traditional desktop, whereby customers can access our freight reservations systems with ease. This has facilitated an increasing proportion of our business being booked via our website,www.irishferriesfreight.com.

Chartering

The Group continued to charter a number of ships to third parties during 2020. Overall external charter revenues were €5.9 million in 2020 (2019: €5.3 million). Of our six owned LoLo container vessels, four are currently on year-long charters to the Group’s container shipping subsidiary Eucon on routes between Ireland and the Continent whilst two are chartered to third parties. The Oscar Wilde continues on a bareboat hire purchase agreement with MSC Mediterranean Shipping Company SA.

Outlook

We look forward to a recovery of our tourism markets once government vaccination programs are significantly advanced, leading to the gradual easing and eventual lifting of Covid-19 travel restrictions. We expect the improvements to our schedule integrity achieved in 2020 to continue and improve into 2021 with the continued benefits derived from our extensive drydock programmes on the Ulysses and Isle of Inishmore and the continued operation of the W.B. Yeats.

Despite the difficult year for the Group, we take comfort from the continued strength of our balance sheet and the high quality and performance of our asset base.

*(Market figures source: Passenger Shipping Association and Cruise & Ferry)